The agreement reached in the FTA negotiations between India and the European Union, which started last year, threatens the Turkish textile and ready-to-wear industries. Sector representatives state that India will gain a great advantage in the region with the addition of zero tax besides the price advantage of nearly 40 percent.

The Free Trade Agreement (FTA) between India and the EU, which started last year after an 8-year hiatus, was agreed upon recently. The FTA, which remains to be signed by the relevant bodies of the parties, is expected to be signed and enter into force next year. The entry into force of this agreement means that India will be able to sell goods to the EU with zero customs duty.

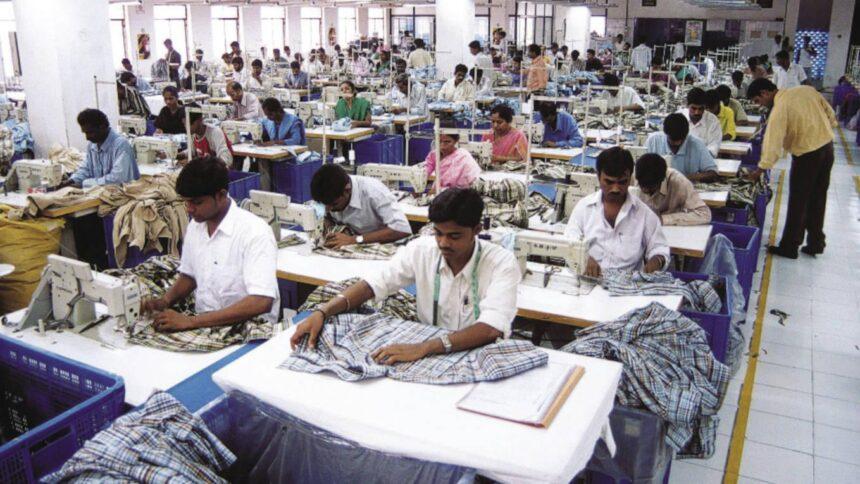

Stating that the costs in both the textile and ready-to-wear industries are much higher than in India and that the price difference between them reaches up to 40 percent, sector representatives are worried that the FTA entering into force will increase the blood loss that has started in both sectors in the EU market. Business people say that the issue may be taken to the World Trade Organization with the concern that it will lead to unfair competition.

Turkey 2nd largest supplier to Europe in textiles

While global textile and raw materials exports were around 380 billion dollars in 2022, apparel exports approached 600 billion dollars. While a 5-6 percent contraction is expected in both sectors globally this year, this contraction is expected to be much higher in the EU. In 2022, the EU’s ready-to-wear and apparel imports amounted to 112 billion Euros, while textile and raw materials imports amounted to 78.2 billion Euros. This year, the region’s textile and apparel imports fell by more than 10 percent. As of 2022, EU ready-to-wear and apparel imports amounted to 113 billion Euros, with a value of 13 billion Euros and a share of 11.5 percent, Turkey became the 3rd largest supplier of the region after China and Bangladesh. In textiles and raw materials, Turkey maintained its position as the 2nd largest supplier of the region with a value of 5.7 billion Euros and a share of 15.2 percent after China.

India is rapidly increasing its share

Although India is lagging behind Turkey in both sectors, the price difference and the fact that it will sell products to the region with zero tax indicates a great danger for Turkey in the coming period. According to 2022 figures, India is the 5th largest apparel supplier in the region with a value of 6 billion Euros in 2022, while it is the 4th supplier in textile and raw materials exports with a value of 2.8 billion Euros.

Decline in both textiles and apparel in the last two years

Moreover, the country’s share of exports to the region is rising rapidly due to its price advantage, despite the tax already applied.

In 2021, India had a share of 3.6 percent of textile and raw materials exports to the EU, while this rate increased to 7.1 percent in 2021 and 7.5 percent in 2022. In the January-May period of this year, this rate increased to 8.7 percent.In ready-to-wear clothing, while India’s share of exports to the region was 3.8 in 2020, this rate increased to 5.3 last year and to 6.5 percent in April this year. In the first five months of the year, Turkey’s share in the region’s apparel imports declined from 12.4 percent to 12.1 percent, while its share in textile and raw materials imports fell from 15.4 percent to 15.2 percent as of 2022

The matter may be taken to the WTO

Ahmet Oksuz, President of the Textile and Raw Materials Exporters’ Association (İTHİB), speaking to EKONOMİ daily on the matter, said that India has recently increased its share in the exports of many sectors in the world with the effect of low cost advantage. It is certain that India will get more share from the European market with low costs, Oksuz said.

Stating that the costs in India are much lower than the world average, “India uses the advantage of cheap labor and cheap energy. It is especially strong in the cotton textile industry because it is a strong cotton grower. India has completed the chain from raw materials to the end product” Oksuz warns and continues: “In that case, it will constitute a situation against us. Countries may take such matters that create unfair competition to the World Trade Organisation”. Oksuz stated that there is no ongoing work as such but a preparation can be made on whether the new application will create unfair competition.

India has a competitive advantage in terms of volume

Öksüz said, “The EU is now focused on what we can supply cheaper and from where. In fact, it is the most sensitive period in this regard. We may produce more value-added products, but it is a bigger country than us in terms of volume.”

The impact would be devastating

Seref Fayat, Chairman of the Union of Chambers and Commodity Exchanges of Türkiye (TOBB) Ready-to-Wear and Apparel Sector Assembly, stated that Turkey will also suffer great damage from the development, which can be considered as a result of the West’s efforts to put India forward as an alternative to China. “We compete with many countries from time to time. We had such a competition with Bangladesh in the past years. Now we are in this process with India. This FTA will accelerate this process even more. I can clearly say that this will be a blow to the Turkish ready-to-wear sector. I would like to say that the effect will be very bad when this is added to many problems such as additional taxes, inability to keep costs, pressure on foreign currency, problems in financing and inflationary pressure” Fayat said.

This FTA with India will spice up the current situation. But still, we should wait and see, says Fayat: “We need to see which product groups and at what rates. But the short, medium and long-term effects of being able to sell products to the EU with zero tax would be very destructive. We need to wait and see the details.

Stating that Turkey’s intervention in unfair competition has always been late, Fayat said, “We also acted late when the Chinese set up factories in Egypt and sold products with their own raw materials and sold them to the EU. For this reason, there is now a threat of Egypt becoming like China. They are still working on this and now Taiwan has started to invest in Egypt. This is our biggest dilemma.”