BY ELIF KARACA

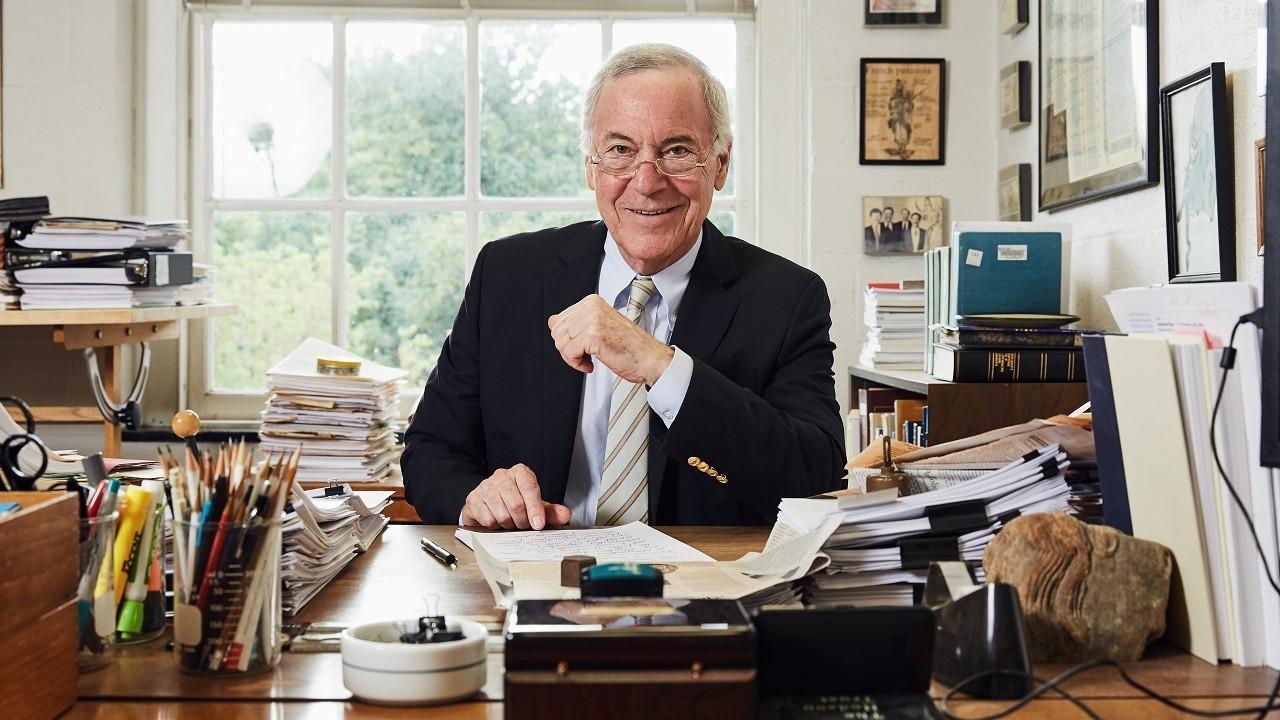

Steve Hanke, professor of applied economics at Johns Hopkins University, who is renowned for his scientific studies on hyperinflation, says that the probability of hyperinflation in Turkey is pretty low from a statistical point of view. “The prospect of hyperinflation in Turkey is not impossible. Turkey has an endemic ‘high’ inflation problem because it is a country with very weak institutions and a central bank (TCMB) with a very bad record,” Hanke said in an exclusive interview with daily DUNYA.

As the record of the TCMB is poor, according to Hanke, the only way to ensure that Turkey will have relatively low inflation and low-interest rates is to do precisely what he did in Bulgaria with the Bulgarian National Bank. “The law governing the Bulgarian National Bank was changed to a currency board law, one that eliminated the possibility of monetary policy discretion and mischief. This has served Bulgaria extremely well for the past 25 years,” he said.

Incidentally, a similar system has been put in place for all of the 70 currency boards that have been implemented in modern history, he added. “The most famous currency board is in Hong Kong,” he reminded. “It’s performed perfectly under all sorts of conditions, including the Asian Financial Crisis of 1997-98 and the more recent political troubles that have visited Hong Kong.”

62 episodes of hyperinflation in world history

The convention adopted in the academic literature is to classify inflation as hyperinflation if the monthly inflation rate exceeds 50%. This definition was adopted in 1956 after Phillip Cagan published his seminal analysis of hyperinflation, which appeared in a book edited by Milton Friedman, Studies in the Quantity Theory of Money. Since Hanke uses high-frequency data and Purchasing Power Parity theory to measure inflation each day in countries with significant price increases, he has been able to refine Cagan’s 50% per month hyperinflation threshold. With improved measurement techniques, he now defines hyperinflation as inflation with a rate exceeding 50% per month for at least 30 consecutive days.

There have been 62 episodes of hyperinflation in world history, all contained in the Hanke-Krus World Hyperinflation Table, according to Hanke. “The highest and most notable is Hungary, which experienced hyperinflation from August 1945 to July 1946. At its peak in July 1946, prices were doubling every 15 hours,” he said.

“Another notable episode of hyperinflation was Zimbabwe, the second-highest in world history, which experienced hyperinflation from March 2007 to November 2008. At its peak in November 2008, I accurately measured that prices were doubling every 24.7 hours. The third highest episode of hyperinflation was in Yugoslavia, where in January of 1994, I measured inflation at 313,000,000% per month,” he said.

The most notable hyperinflation episode was that of Germany after the first world war, the fifth-highest rate of hyperinflation in world history, according to Hanke. “At its peak in October 1923, inflation was 29,500% per month, much less than that of Hungary, Zimbabwe, or Yugoslavia,” he noted.

All of this hyperinflation have resulted in economic chaos and a complete collapse of the economies experiencing hyperinflation, the economist said. “Usually, but not always, governments have fallen as a result of te hyperinflation. Recent examples of leaders hanging on for years in the face of hyperinflation have been Mugabe in Zimbabwe and Maduro in Venezuela.”

Solutions involved currency reforms

The solutions to these instances of hyperinflation have always involved major currency reforms, said Hanke. “Zimbabweans stopped using the Zimbabwe dollar and the economy spontaneously dollarized in November 2008. By January 2009, the country had formally abandoned the Zimbabwe dollar and had officially become dollarized. As a result of this dollarization and the installation of a national unity government in 2009, the economy rebounded,” he cited.

Bulgaria represents yet another example of smashing hyperinflation with currency reform and it presents an important model for Turkey, according to Hanke. This is not only because Bulgaria is Turkey’s neighbor, but because a Bulgarian-type currency board is exactly what Hanke proposes for Turkey. This is detailed in a book he co-authored with Dr. Kurt Schuler, Gelişmekte Olan Ülkeler İçin Para Kurulları, which has been published in Turkey.

Bulgarian currency board as an example for Turkey

Detailing the Bulgaria example, Hanke said that “in February 1997, the monthly inflation rate peaked at 242% per month. At that time, I was called in as President Petar Stoyanov’s Chief Adviser. I designed Bulgaria’s currency board,” Hanke said. None of the 70 currency boards established throughout history have failed, he added.

“A currency board issues notes and coins convertible on demand into a foreign anchor currency at a fixed rate of exchange. The country must hold anchor‐ currency reserves equal to 100% of monetary liabilities. The country has no discretionary monetary powers and cannot issue credit. It has an exchange-rate policy but no monetary policy. Its sole function is to exchange the domestic currency it issues for an anchor currency at a fixed rate. A currency board requires no preconditions and can be installed rapidly. Government finances, state-owned enterprises, and trade need not be reformed before a currency board can issue money,” he said, “With the Bulgarian currency board installed in July 1997, hyperinflation stopped immediately. By 1998, the banking system was solvent, money-market interest rates had plunged from triple digits to an average of 2.4%, a massive fiscal deficit turned into a surplus, a deep depression became economic growth, and Bulgaria’s foreign‐ exchange reserves more than tripled.”