Vice President Cevdet Yılmaz answered the questions of EKONOMİ Daily. Yılmaz said that the base effect in inflation is important, but without the program effect, this alone will not be enough to reduce inflation. Emphasizing that there will definitely not be a hard landing in the economy, Yılmaz said, “We do not see any danger in this regard. There may be partial regressions in the growth rate, but we will definitely not go to the negative side.”

Yılmaz said that Turkey cannot get out of the current middle-income trap with low labor wages and that technology must be increased.

Emphasizing that the Medium Term Program (MTP) is based on the technical assessments of the Central Bank regarding inflation, Cevdet Yılmaz noted that the President has strong political support for the program implemented and that there is no problem in the coordination of the economy.

Cevdet Yılmaz stated that the incentive system will be made more effective and target-oriented simplification will be made in this context, and said, “It is a matter of creating a more efficient and competitive structure based on knowledge and technology, Turkey has reached this threshold and we will overcome it.”

How will the MTP be revised? Are there any changes envisaged in inflation targets?

“We will update the Medium Term Program by preserving our main policy framework. We will update it by preserving the main targets, while taking into account the developments in Turkey and the world. All macro figures are being updated, including growth, employment, foreign trade, tourism and inflation. But of course, inflation will be revisited in dialog with the Central Bank according to the conditions of the day. After all, this is a government document. We take the technical evaluations and data of the Central Bank as a basis and we look at them in dialog with them.

Of course, the Central Bank also has its own process, inflation reports, etc., and that process works in its own way. These figures are revisited every year in the MTP. We are currently in the disinflation process. When we announced the MTP last semester, we said there would be three periods: the first period is the transition period, the second period is disinflation, and the third period is permanent price stability.

We have completed the first period, the transition period, and now we have entered the disinflation period. A period of declining inflation rates started in June. It was 61.8 in July, and we expect it to be in the low 50s in August and below 50 in September. This is what we see when we look at the current technical figures. Of course, there are developments in the world that we cannot control, provided there are no surprises. There may always be things that we cannot see positively or negatively, but this is what we see right now. Therefore, it has entered a serious decline process.

There are two effects here: One is the base effect and the other is the program effect. Right now, the base effect is helping us, but without the program effect, there is no base effect. I always say this, sometimes it is spoken as if the base effect is something automatic. If you don’t implement a program, if that program doesn’t yield any results, that base effect will not occur. Therefore, there is both a base effect and a program effect. This is a good thing, and it is also an important process for expectations to reach their targets. Our Central Bank has recently started to publish the expectations of both professionals and citizens.”

If inflation moves towards 45-50 percent, will there be an interest rate cut?

“Frankly, we don’t want to get into these discussions. It is the Central Bank’s business, they will see the trend in the inflation report, they will look at the trend in the underlying trend of inflation. They will look at the expectations, they will look at the conditions and they will decide accordingly, but politically I can say that high inflation is not a good thing and high interest rates are not a good thing. As a result, we aim to bring both of them to lower levels in the medium term, and hopefully we will achieve this. We have a single-digit inflation target in 2026, and Turkey has achieved this in the past in 2013. In May 2013, interest rates had fallen to 4.5 percent and inflation was around 6.2 percent, so Turkey has achieved this in the past and we will achieve it again.”

“We expect new good news for foreign investment”

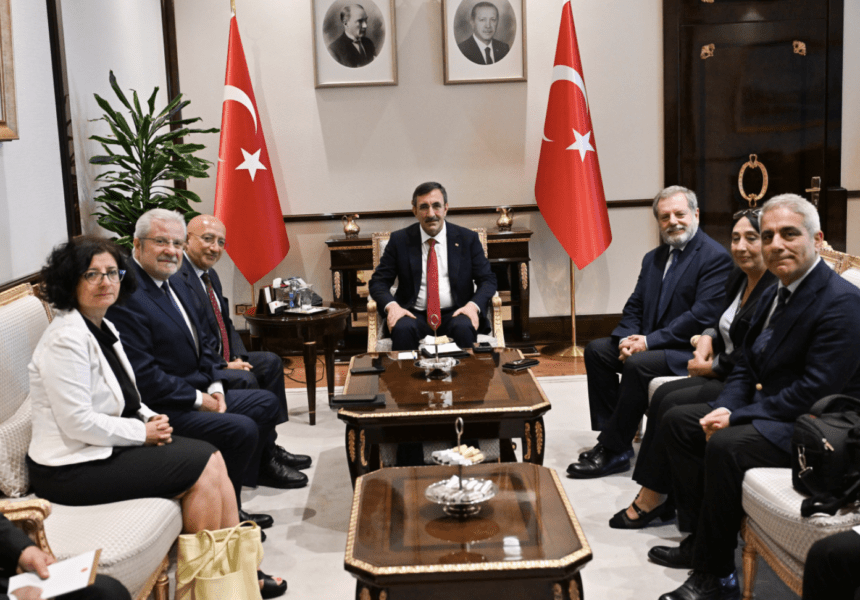

Vice President Cevdet Yılmaz announced that they invited foreign investors to the Investment Advisory Council at the Investment Environment Improvement Coordination Board (YOİKK) Meeting held yesterday. Emphasizing that international companies have entered a period in which they announced their decision to invest in Turkey, Yılmaz said, “We expect new good news to come in the coming period. On September 28, we invited foreign investors to the Investment Advisory Council.”

Stating that the work to create an incentive system that will respond to the needs of the private sector and prioritize high value-added investment has reached the final stage, Yılmaz said that they have started consultations for the MTP that will cover the years 2025-2027, and that meetings with stakeholders from different sectors will continue this month.