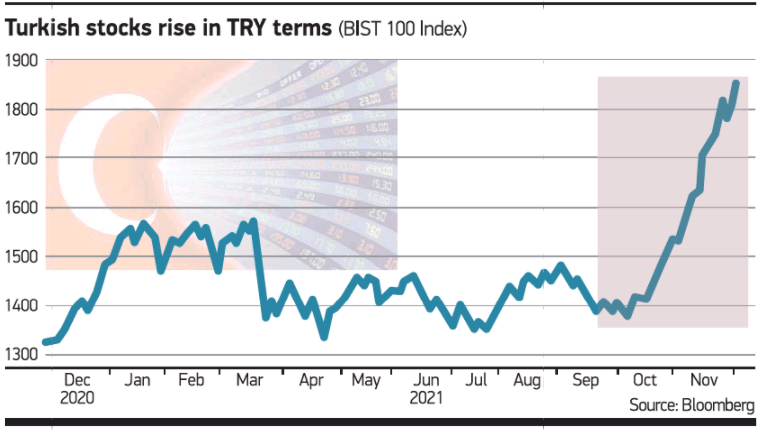

Turkish stocks are on the rise as TRY devaluation has led to domestic investors trying to protect their savings. This rise has also made equities very cheap for nonresidents. The benchmark Borsa Istanbul 100 index has risen by 32% in TRY terms so far in the fourth quarter (Q4), which makes it one of the top performers among the global equity markets. However, it fell by 12% in USD terms and became the worst performer (in terms of value) in the same period. “When the currency is weak and rates are low, stocks stand out as one of the attractive asset classes left to protect savings for locals, especially for those who may be thinking they’re too late to catch the foreign exchange rally,” said Burak Isyar, Equity Research Head of ICBC (Industrial and Commercial Bank of China) Yatirim.

On the other hand, foreign investors have bought USD 1bn equities in Q4 as of November 19, with Borsa Istanbul’s benchmark index trading near its lowest level since 2009 in USD terms. Exporters are a beneficiary of the weak TRY and Turkish stocks are very cheap for foreign buyers in USD, according to Isyar. “Turkish stocks come out as winners under the current conjecture,” he noted. (Bloomberg)