BY TALIP AKTAS

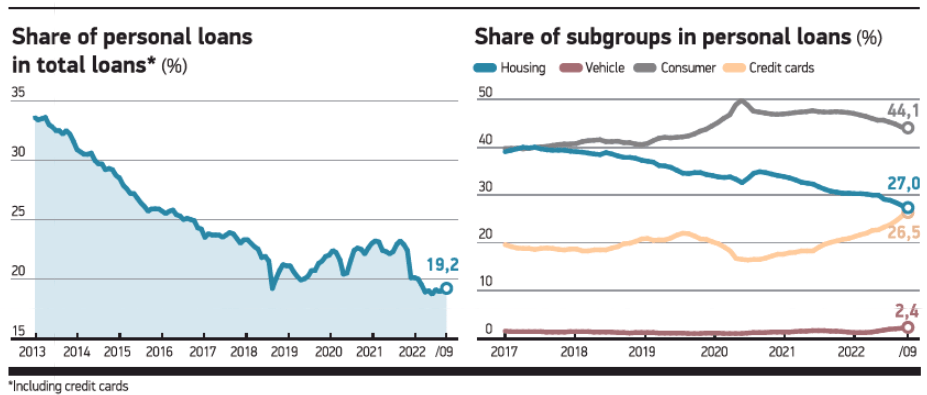

The ratio of personal loans and credit cards to total loans, which hovers around 30-35% ordinarily, fell below 20% in 2022, according to the Banking Regulation and Supervision Agency. There are a few reasons for this. Real wages declined, decreasing purchasing power in real terms against high inflation, which reduces the tendency of purchasing and loan demand. Loans are under pressure; installment limitations have been implemented for purchases made through consumer loans and credit cards. Banks are selective; the difficulty in making payments leads to banks being more selective when issuing personal loans. Moreover, banks are obliged to hold low-interest rate-yield government bonds for personal loans. These decrease banks’ appetite to provide personal loans. The composition of loans also changed; high inflation and erosion in real wages significantly changed the composition of personal loans. The share of housing loans fell from 40% to 28% and the share of consumer loans, which mainly consists of short-term cash borrowing, surged by 5 points and exceeded 44%. The share of credit card balances rose by 6.5 points to 26.5%, hitting a historic high. People have headed towards consumer loans, which are more expensive and hard to access, and are pushing their credit card limits.