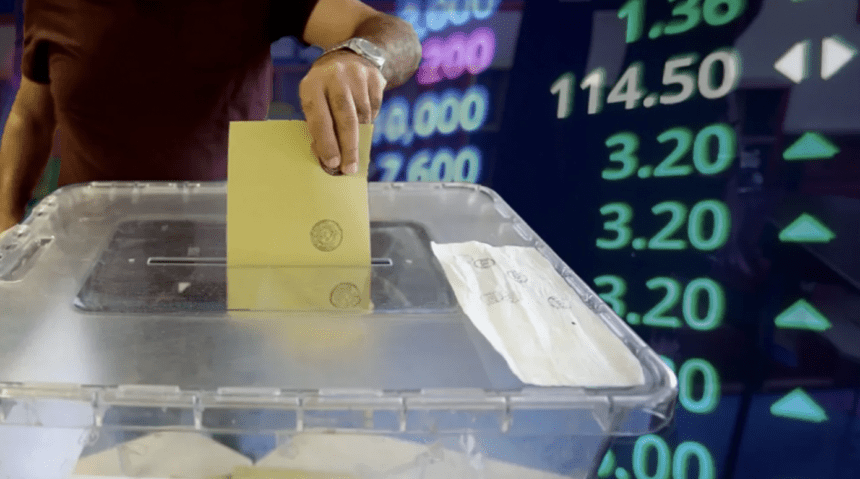

As the local elections approach, domestic markets are on the move. Experts who made evaluations to EKONOMİ newspaper believe that the local elections will not have a direct impact on the market. Experts do not expect a rapid rise in the dollar if the current economic policies are maintained, and are optimistic about inflation and the stock market. Fitch’s rating upgrade before the elections also supports the positive mood.

While Borsa Istanbul could not protect its investors against inflation, gaining 36 percent in value in the whole of 2023, it gained more than 80 percent in the rally that started after the general elections and continued until September. On the other hand, the USD/TL rose strongly from May 28, 2023, when the presidential election was concluded, until mid-July, with a premium of 35 percent; the exchange rate continued its gradual increase afterwards. In all of 2023, the dollar appreciated by 58 percent against the Turkish lira.

The downward trend in the stock market, which lasted for about 4 months, gave way to an upward trend as of the beginning of January, and the BIST100 index broke record after record, reaching its intraday historical peak of 9450 points on February 26. On the USD/TL side, while the demand for dollars has increased recently with the expectation that ‘it will appreciate rapidly after the election’, the rise has also accelerated and the monthly average premium has increased from 2 percent to 3.5 percent. On the other hand, last Tuesday, the exchange rate gap between the interbank market and the Grand Bazaar increased up to 5 percent as citizens’ demand for foreign currency shifted from digital to physical dollars. While the gap later decreased to 2 percent; the events reminded the exchange rate gap that opened up to 10 percent during the general election period in 2023.

Eyes will be on post-election economic policies

The difference that distinguishes the local elections to be held at the end of March from previous local elections is the monetary policy that started to be implemented after the general elections in 2023 and the developments that will be followed to see whether there will be a change in the new economic administration. Experts point out that if there is a change in the tight monetary policy and/or economic management, markets may experience volatility. In addition, foreign investors are expected to closely follow the road map after the elections and foreign inflows to the country may accelerate if the policies pursued continue.

On the other hand, Treasury and Finance Minister Mehmet Şimşek said last week that they did not expect a real depreciation in the exchange rate and said, “Expectations regarding the depreciation of the TL after the elections do not make much sense to me.” On Friday last week, international rating agency Fitch upgraded Turkey’s credit rating for the first time in 12 years. Turkey’s credit rating was raised to “B+” and the outlook was changed to “positive”. Fitch’s decision is expected to support the positive sentiment in Turkish markets.

Market experts told EKONOMİ newspaper that the local elections will not have a direct impact on the market. They emphasize that if the current economic policies are maintained after the elections, the dollar will not rise rapidly, inflation will start to decline due to the base effect and the stock market will become more attractive for investors.

Istanbul election result is crucial

Mert Yilmaz, Deputy General Manager of Info Investment;

“Although it is a local election, I think the Istanbul election result is extremely important. The concern here is: If Murat Kurum loses the election, ‘Will the current policy continue and will those who implement this policy remain in office?’ This uncertainty seems to have drawn domestic and foreign investors into a wait-and-see mood. 9400-9450 was an important resistance level. The stock market went this far and started a reasonable correction movement. There is an effort to hold on to 8800 points in the first place. If the selling pressure continues, we may see a pullback to 8450-8500 levels. On the other hand, there has been an increase in the demand for foreign currency, especially by individual investors in recent days. It is said that the Central Bank wants banks to widen the gap between buying and selling rates. The pictures seen in the Grand Bazaar also support this. In summary, I do not expect a sharp movement neither on the foreign exchange nor on the stock market. But according to the election result, if the expectation that this staff and policies will continue to be implemented is strengthened and the markets are convinced, I think that foreign interest may reappear and the stock market will be in favor of the stock market.”

Exchange rates will rise at a moderate pace after the election

Inveo Portfolio Fund Management Manager Eral Karayazici;

“The stock market has been losing value for 2 weeks following an eight-week rally. The retreat from the USD 305 peak lasted until USD 278. It is possible to test the USD 265-270 band in the pre-election period. However, in the post-election period, regardless of the election result, provided that there is no change in economic policies, it is more likely that we will encounter a new upward movement in the stock market that will target USD 340 in the summer months under the leadership of banks. The star of the first quarter of the year in Borsa Istanbul was the small companies index (TUMY). While the BIST 100 index is 18 percent above last year’s close at its current price (in TRY terms), this index is trading at a 35 percent premium. Due to the price disadvantage, I think that the small companies index will have difficulty in participating in the rise in the stock market in the next 1-2 quarters, so investors would be better off choosing from the large companies index. On the foreign exchange front, there is demand from residents on the eve of the election. This may continue until the end of the month. However, provided that there is no change in economic policies, I think that after the election is over, this front will calm down again, and the increase in exchange rates will continue at a moderate pace, close to the monthly inflation rate, but below the return on deposits.”

Volatility may increase towards the election

Eda Karadag, Deputy Manager of Investment Advisory at Gedik Investment;

“The local election to be held at the end of the month creates uncertainty in the markets for now. As the time towards the election narrows, it may cause an increase in volatility in the markets. In the BIST100 index, movements below 9000 points continue to worry the markets. Especially investors are wondering what the course of the index will be after the elections. Actually, it is difficult to give a clear answer to this question. First of all, the markets will be relieved that the uncertainty of an election is behind us. After that, markets will focus on the main story. I believe that inflation and the CBRT’s monetary policy steps will be the main factors that will determine the course of the markets. At the same time, foreign institutions’ reports or statements on Turkey may also contribute to this. In particular, the fact that the CBRT wants to maintain its current stance and continue to fight inflation and strengthen its communication with the markets can actually be interpreted as a positive development. For the post-election period, it will be important to maintain the current stance and focus on this.”

I do not expect a rapid rise after the election

Ahlatci Investment Executive Vice President Tonguc Erbas;

“I do not expect the local elections to have a direct impact on the markets. However, I think that the clarifications of the economic program may be more important for exchange rate pricing and the stock market rise. On the other hand, the conclusion of the local elections will of course be a turning point for domestic and foreign investors who may create expectations as political risk. After the elections, I expect the rise in the exchange rate to continue until a downward path in inflation is achieved, which is not expected before the summer months. Even if a rise in line with inflation expectations is realized, this would mean an annual rise of 36 percent in the exchange rate. In this case, a higher-than-expected foreign capital inflow to Turkey may put pressure on the exchange rate; I see the second half of the year as a higher probability for this expectation. If the local elections are entered with exchange rate pricing at TRY 32 levels, a gradual rise in the exchange rate up to TRY 35 can be expected to continue until the summer months. On the stock market side, if the downward pricing continues before the local elections, similar to the general elections; I think that the rise after the elections may continue with the rating and outlook upgrades from credit rating agencies and a new rally may be experienced, especially if the gradual expansion policy to be implemented in foreign swap transactions is implemented.”

My post-election stock market outlook is quite positive

Murat Ozsoy, Founder of Biz Financial Consulting;

“I do not expect a rapid rise, but it should be kept in mind that we will enter a period of increasing risks. In 2024, there is an increase in the rate of depreciation of the TL against the dollar compared to late 2023. If this increase continues at the current monthly rate, we will probably enter the elections with an exchange rate of TRY 32.20. Immediately afterwards, I do not expect an even faster loss in TRY. My year-end exchange rate expectation is around TRY 42 under current conditions. On the stock market side, my views are quite positive. Starting from the post-election period, especially from May to September, there will be a significant decline in the rate of increase in inflation due to the base effect. I think this will not require an additional tightening in monetary policy and this will benefit the stock market. Not in terms of being an alternative to inflation, but in terms of preventing the loss of company values through policy rate hikes. Even if inflation continues as it is, it is already very difficult to find instruments other than the stock market and mutual funds.”