BY ALAATTIN AKTAS

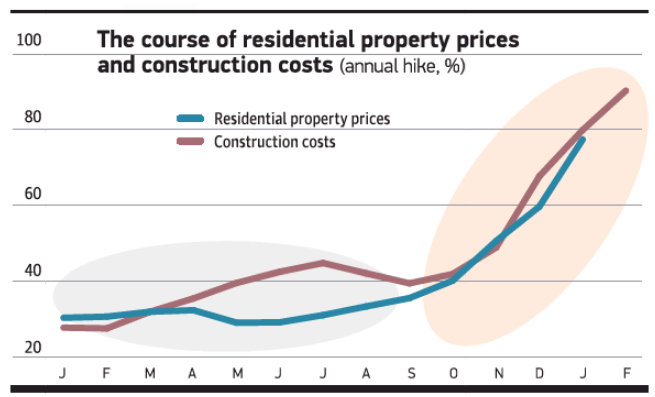

The policy rate cuts were nothing but wiring the first button wrong. Inflation had to decline when the policy rate was reduced. But Turkey experienced inflation that hasn’t been seen for 20 years. Foreign exchange (FX) rates jumped when the policy rate was cut. The hike was stopped (for now) with a bizarre system called the FX-Protected TRY deposit account (KKM). To get an interest rate of around 15% for deposit accounts means losing the principal amount in an environment where inflation is estimated not to fall below 50-60% in the next year. So, some account owners chose the KKM, while those whose savings are higher headed for houses. There are three factors in the surge in residential property prices: Cost increase; demand increase stemming from savers, who use houses to protect their savings; demand increase from foreigners, and the price hike of those who justify this increase. Construction costs rose by 28-44% in the first eight months of 2021 and residential property prices hovered around 30-33% in the first eight months of 2021. The annual hike in construction costs and residential property prices has reached 90% and 77%, respectively, as of February. The share of foreigners in total house purchases across Turkey has reached 4.7%, hitting an all-time high. Moreover, the limit for the real estate to gain Turkish citizenship will be raised from USD 250,000 to USD 400,000.