BY BADER ARSLAN

Despite high price increases and the growing current account deficit, the Turkish economy is ending a quarter in which exports contributed significantly to industrial production and growth. Yes, a significant part of the first quarter performance, which exceeded 20 percent for exports, is due to global price increases and the growth of target markets. However, we are taking on this wind, which is not in our control in the short term, from the right angle. At this point, the export-oriented loan package announcement last Thursday will make a meaningful contribution in the long run.

INDUSTRIAL PRODUCTION INCREASES BY DOUBLE DIGITS

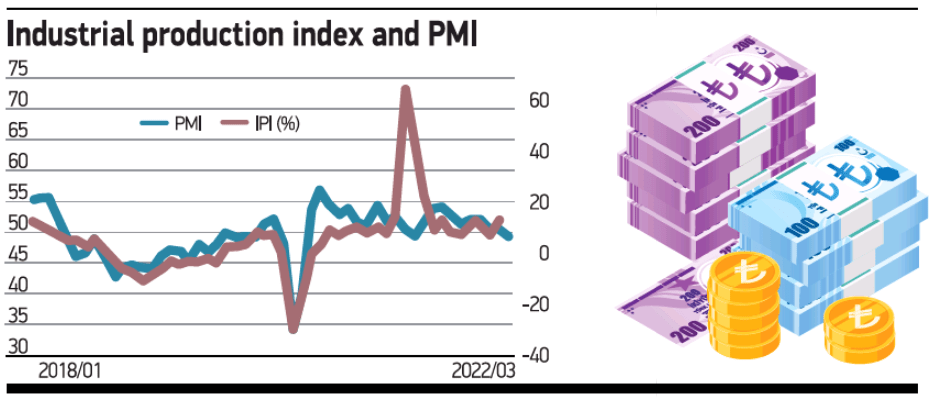

The February industrial production index performed much better than expected. Industrial production, which increased by 13.3 percent on an annual basis, is a good indicator for growth. PMI, which was just above 50 in recent months, declined to 49.4 in March. Despite the dim PMI outlook in January and February, industrial production showed a brisk increase. The change in the index was in double digits in three of the last four months.

However, it should be noted that this extraordinary performance of the index does not coincide with PMI data. Therefore, the divergence between these two indicators is expected to normalize in the coming months.

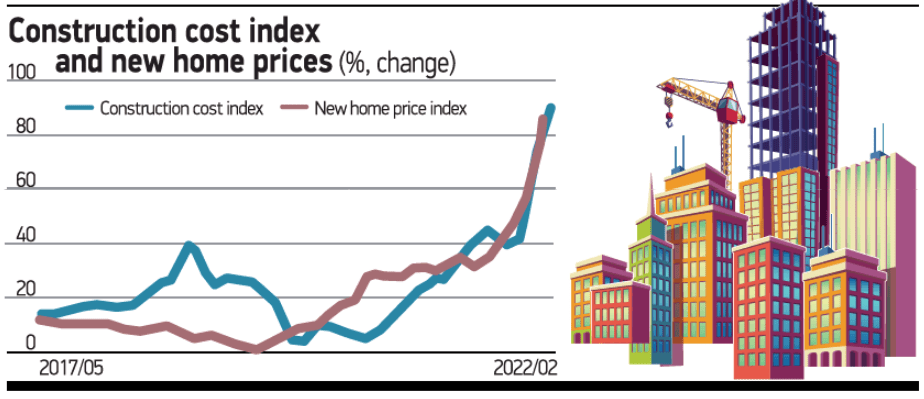

INCREASE IN CONSTRUCTION COSTS EXCEEDED 90 PERCENT

The construction cost index, announced last week, rose 90.3 percent year-on-year in February. While the increase in material prices, one of the two main items that make up the construction cost index, was 113.3 percent, the increase in labor costs rose to 41.4 percent.

Two years ago, the increase in costs was in the single digits, but now it is close to 100 percent. Although the increase is mostly due to the rise in material prices, there has been a serious jump in labor costs in recent months. This indicates that housing prices will continue to increase in the coming period. The fact that those who do not want to receive interest income well below inflation see the purchase of housing as an investment tool will continue to drive this process.

MEANINGFUL SUPPORT FOR EXPORT INVESTMENTS

Last Thursday evening, the President’s announcement of long-term financing opportunities in Turkish lira with an annual interest rate of up to 9 percent in addition to the use of domestic machinery, partial foreign financing, and regional incentives for export-oriented investments is something that should be underlined. In line with the principles of project finance, a loan package of 150 billion liras, of which 100 billion liras is for exports and 50 billion liras for tourism, is 250 million liras for SMEs and 1.5 billion liras for non-SME companies. These loans will be used with an annual interest rate of up to 9 percent and a maturity of 3 to 10 years with a grace period of 2 years.

Our current export growth is doing well due to global price increases and buoyant foreign demand. The new loan package the President hinted at is the right move and a positive practice for export infrastructure and export-oriented industrial production in the medium and long term. It may be more effective if such supports are implemented in areas with higher added value and for companies that have higher-level supply chains.

INTEREST REMAINS FIXED

The MPC did not change interest rates and left the policy rate unchanged at 14 percent. That’s what was expected. However, a portion of the statement they made following the meeting was noteworthy: “The Board predicts that the disinflationary process will begin with the re-establishment of global peace and the elimination of base effects in inflation, together with the steps taken to establish sustainable price stability and financial stability.” There it is: the re-establishment of the global peace environment and the elimination of base effects in inflation.

It is currently unknown when peace will be established. When this happens, how much it will affect domestic inflation is a separate issue, because domestic inflation had been on the rise long before the Russia-Ukraine War. Of course, the conflict had an impact on inflation as the war pushed up commodity prices, but this explains only a small part of the overall rate of price increase. We have six months until the base effects in inflation to disappear. Therefore, one should not expect any decrease from this anytime soon, either.

THIS WEEK…

The data agenda is light this week. The housing price index and consumer confidence index will be the most important things released. In both, we will likely see results similar to those in recent months: a rapid rise in housing prices and weak consumer confidence. For this reason, we are starting a week where explanations will be more effective than data.