BY ALAATTIN AKTAS

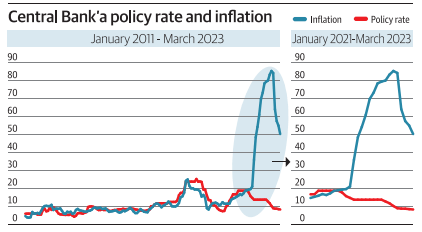

The Central Bank’s (CB) policy rate and inflation had a parallel course from the beginning of 2011 to September 2021. However, there were periods when inflation showed itself. For instance, the dismissal process of unmanageable CB governors. The policy rate was cut when obeyer governors were appointed. The different long-term targets seemed to be on the carpet. Economic boom and growth were prioritized, and inflation was put on the back burner. The difference between policy rate and inflation highly increased. The current downward trend in inflation stems from the base effect but not measures. FX rates have had a horizontal course for months. But we didn’t see the impact of the FX rate hike in April on prices on an index basis. Statements to continue rate cuts seem to score points as it’s easier to impress on society the idea that inflation declines when the policy rate is cut. Inflation doesn’t fall. It is the annual rate of increase that declines. But what matters is the decrease in annual inflation, which declined to 50% from 85%. For instance, it’ll be interesting to see what happens when the policy rate is lowered to 1%, and the CB provides funds to banks as much as they demand…