BY KORAY OZTOPCU

Garanti BBVA Consumer Finance Director Koray Oztopcu evaluates the world automotive sector under the global axis, supply process change and sustainable consumer finance in his column.

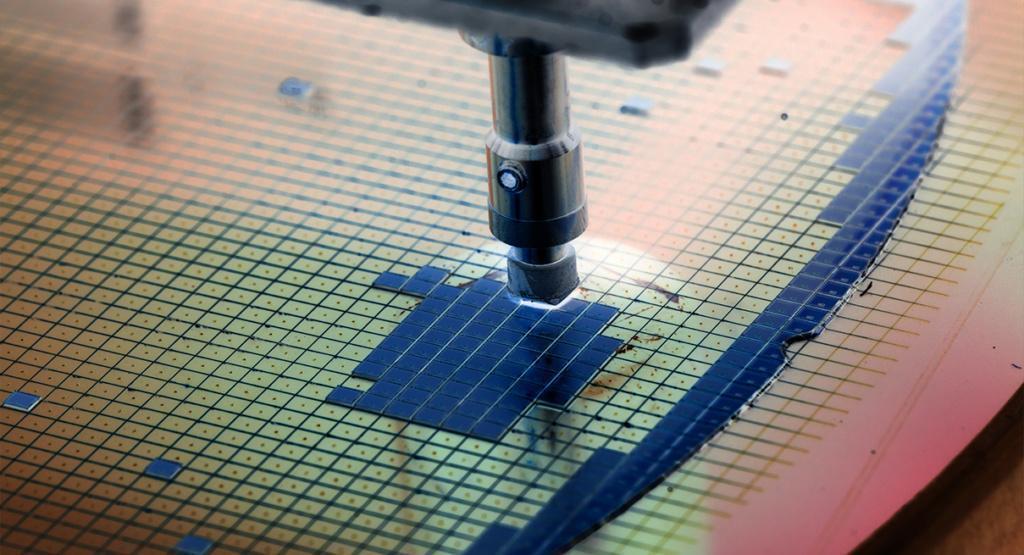

With the pandemic, demands for digitalization and sustainable mobility have increased significantly. Accordingly, chip and semiconductor production, which is involved in most of the products we use in our daily lives, has recently become one of the most discussed issues in global power balances.

The use of chips is increasing day by day in various phones including the smart models, computers, cars, game consoles, solar energy systems and smart home devices, as well as semiconductors produced for the defense industry, space and aerospace.

Considering the Asian market, Taiwan’s works in the international semiconductor (chip) industry began in the 1980s. At that time, production has been carried out in the facilities of the world’s leading semiconductor companies in their own countries. However, the further complex development of the chips made production extremely costly.

The different cooperation and working models that emerged in Taiwan in 1987 led many manufacturers around the world to do business in Asian region. These new companies, which have been making contract manufacturing, were producing semiconductors on a wide scale and in line with the engineering companies’ demands. While the companies operating under this model tended to mostly R&D activities, they also had their contract manufacturing done under license in these areas. This trend has caused the decline in US’ semiconductor manufacturing capacity, which held roughly 40% of the global market share in 1990 and 12% in 2020.

In 2020, we see that the largest Taiwanese manufacturer has reached 54% of the world’s revenues in this field, and some of the largest technology companies in U.S. produce approximately 90% percent of their chips in Taiwan. Today, Taiwan, Japan and South Korea account for about 80% of global production capacity. On the other hand, we also hear that the rising tension in Asia may cause serious disruptions in the production of these chips with knock-on effects in the automotive and global consumer electronics industry.

We see Taiwanese major manufacturers produce more than 10,000 different products for around 500 customers worldwide. Contributing to almost every branch of the global economy, from the leading phone manufacturers to computer manufacturers, from the aerospace industry to automobile manufacturing and electronic products, this sector has a very strategic importance. While the number of manufacturers in this area reaches up to 20, we see that they produce in the free zone created in the semiconductor metropolis of Hsichnu on Taiwan’s northwest coast.

While Taiwan produces roughly 50% of all semiconductors in the world; steps such as digitalization, artificial intelligence or autonomous driving, which determine the future of the automotive industry, also enable R&D activities to continue that are dependent on semiconductors.

Global axis change and its effect on the world automotive economy

In the past, the USA had directed both U.S. and Asian high-tech companies to open production facilities in the USA against the negative consequences of being so dependent on contract manufacturing in Asia. So, as a result of this, Taiwan’s largest chip manufacturer will start production in 2024 at its factory to be established in Arizona with a cost of USD 12bn.

It is thought that the balance change in Asia would have a major knock-on effect on the world automotive economy. While a USD 280bn incentive bill for chip production was approved in the U.S., approximately USD 52bn-worth support for semiconductor production is offered, as well as a 25% tax cut for four years to encourage factory installation. The subsidies offered to encourage the establishment of new chip factories in U.S. will be available to subcontract chip manufacturers in Asia who have pledged not to manufacture in China. With the increasing need for technology, countries have been making an intense effort for years to bring back the production of high-tech components, which are contracted for the defense and aerospace industry, to their own countries.

European countries are also taking steps to reduce dependency on Asian chip manufacturers. The European Commission plans to unveil the package that would support the chip industry with EUR 43bn in public funds, with the European Chip Act to double Europe’s share in global chip production from 10 to 20% by 2030. As the first step in this context, a chip factory is planned to be established in the northeast of Germany. On the other hand, South Korea’s leading technology company also announced that they agreed to start production of semiconductors in Vietnam in 2023.

We can clearly see the impact of raw material and supply shortages and semiconductor production on automotive production in the European automotive market. According to the sum of EU (26), UK and EFTA countries, the total automotive market decreased by 14.8%, the automobile market by 13.7% and the light commercial vehicle market by 24% in the January-June 2022 period compared to the same period of the previous year and amounted to 6,615.004 units. In the same period of 2021, it has reached a total of 7,768,154 units. We also see similar supply-driven declines in Europe’s largest markets. The automotive market in Germany decreased by 19% from 308K to 250K; from 224K to 171K units in UK with a decrease of 23.7%, and from 251K to 212K units in France with a decrease of 15.6%.

Carbon neutral target, sustainability actions, automotive industry and EVs in Turkey

When we look at Turkey, we see that we are the 6th country in the European automotive sales ranking with a decrease of 8.8% between January and June 2022, compared to the previous year. In July 2022, automotive sales in Turkey, with 52,206 units, increased by 9.1% in monthly-basis compared to the previous year, but decreased by 7.3% in the January-July 2022 period with 410,110 units. In electric vehicles (EV) on the other hand, the global car industry is projected to reach 20.6 million units sales in 2025, compared to 6.6 million this year. By 2025, electric vehicles will account for 39% of passenger car sales in China and Europe, and between 40% and 50% in the UK, Germany and France.

It is predicted that China and Europe will account for 80% of all EV sales globally by 2025, with the US representing only 15% of the world’s EV sales. At the end of 2021, we see that hybrid vehicles have reached a sales figure of 49,493 in our country. In the same period of the previous year, this figure was 24,131. Electric vehicles on the other hand, reached a sales of 2,846 units at the end of 2021, compared to 844 in 2020. This shows us that electric and hybrid vehicles are becoming more and more preferred year after year.

In the January-July 2022 period, hybrid car sales took a 9.5% share with 30,417 units, while 2,532 electric automobiles were sold. In the same period of 2021, these figures were 29,918 in hybrid cars and 1,019 in electric cars.

As Garanti BBVA, with the understanding of “We take good care of the world, we take good care of the future”, we offer our individual and corporate customers environmentally friendly vehicle loans with affordable interest rates with free HGS in order to take the steps in the development of the ecosystem faster, to contribute to reaching a sustainable future, support mobility, and to move towards our 2053 carbon neutral target.

Pioneering practices and incentives continue to be provided for electric charging stations to be implemented by the private sector in order to accelerate the charging infrastructure in order to enable consumers, one of the most important factors in the development of electric vehicles in our country, to adopt electric vehicles more easily. In this way, Turkey will become one of the leading countries that increase its fast-charging capacity.

As Garanti BBVA, we provide shopping loans to our individual customers to accelerate the development of the ecosystem created by electric vehicles, to establish fast charging stations for electric vehicles and to finance electric vehicle charging stations. In this context, through contracted company dealers, we offer our individual customers a shopping loan of up to TRY 30,000 with a maturity of three to 36 months, who want to set up an e-charging station to install their chargers on sites and detached houses.

Today, in line with the increasing raw material shortages due to the Ukraine-Russia war, possible semiconductor supply problems that may arise with the China-Taiwan tension, the damages in international commodity markets and the negative impact of these damages on supply chains and logistics seem to slow down the change in the automotive industry and the ecosystem to be formed. However, this situation can also open the way for new formations and opportunities. The 500 billion dollars allocated by the automotive industry for the change in this ecosystem also shows how important the process is. Therefore, in addition to sustainable consumer finance and end-to-end financing solutions such as instant loans and digital vehicle loans offered to consumers at the dealership, charging station and service loans products will become increasingly important in the transformation of the automotive industry.