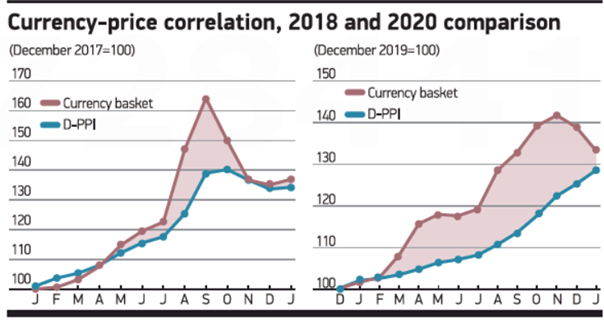

The USD/TRY has dropped from 8.50 to almost 7, and the euro from 10 to 8.50 but prices continue to increase. In a sense, 2020 is a repeat of 2018: the exchange rate rose precipitously and then an increase in interest rates stopped the climb and eventually triggered a decline. But the trend is actually quite different from 2018 in many other ways. Let’s look at the graphs where I’ve turned the exchange rate and D-PPI fluctuations in 2018 2020 into a chain index. The currency basket and the price increase in 2018 are almost parallel until July. The rate increase reaches 20% and 12% in August and September. The poison enters the body (price) but the body reacts immediately; that is, high hikes come and the exchange rate effect begins to rapidly reverse.

This year, things are very different. The exchange rate and price increases begin to diverge by March. Eleven months later, in January, the exchange rate is still high. So poison is being constantly injected into the body. The currency basket has been declining for two months but there’s such a high cost residue has accumulated from skyrocketing exchange rates over the previous months that it does not seem be able to remove the poison from the body.

ALATTIN AKTAS