BY TALIP AKTAS

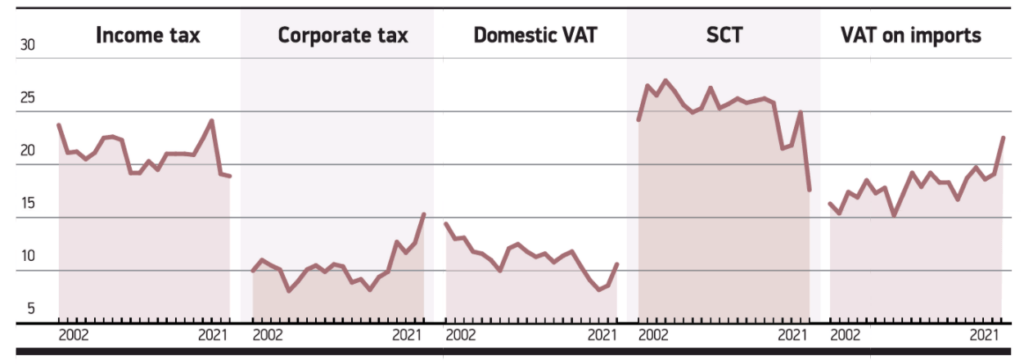

Imports and exports hit an all-time high in 2021. Imports, which exceeded USD 217bn, caused a considerable change in the composition of budget revenues. The new economic model made a positive contribution to the budget balance as a result of imports. The Value-Added Tax (VAT) levied on imports generated TRY 261.9bn of total tax revenues, which totaled TRY 1.16tr. The share of VAT on imports of total tax revenues reached 22.5% for the first time in 2021. The share of total revenue comprised by the Special Consumption Tax (SCT), which has hovered around 25-27%, its peak since it was imposed in 2002, fell to 17.6%, ranking 3rd for the first time ever. The decrease stemmed from the reduction to zero of tax on fuel through gradual reductions and a decline in automobile sales due to the supply shortage. The share held by the income tax, which has averaged around 21-22% for many years, fell below 19% for the first time in 2021. The share held by corporate tax exceeded 15% for the first time in 2021. Collections from successive restructuring of tax debts played an important role in the relative surge in corporate tax over the past four years. The dramatic changes in the source of taxes in 2021 should also be read in the light of pandemic conditions.