BY TALIP AKTAS

It is critical that the Central Bank achieves price stability. Economic growth potential will increase, interest rates will be lower, inefficient expenditures and investments will decrease, dollarization will decline, and income inequality will be prevented. The CB says interest rates will be lower in an economy in which price stability is achieved. In brief, it says, ‘high interest rates cause inflation’. Although the policy rate is the key instrument to achieve price stability and keep inflation low, official sources have recently said it was rendered insignificant. Considering the increasing difference between the policy rate and loan-deposit rates, the CB’s power to influence economic activities and inflation through the policy rate has disappeared. If the policy rate is made non-functional, this can be read as abandoning the fight against inflation or leaving it to the ‘success’ of grocery audits.

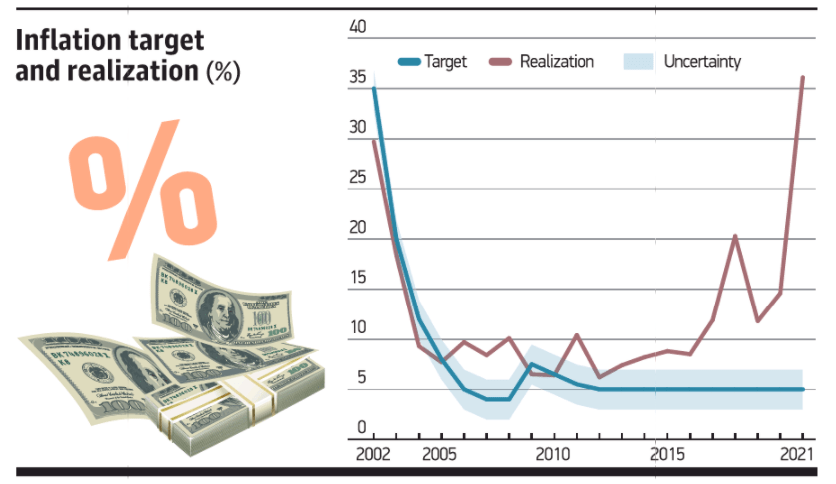

The CB has implemented the ‘inflation targeting’ regime for price stability since 2006. The target was achieved for only five years in this period. In 2009 and 2010 inflation remained below the target. The CB’s year-end inflation target has been 5% since 2012. The average inflation has been over 13% for the past decade. At this point, there is the question of how the Central Bank, which abandoned the policy rate, sets the inflation target and direct markets by it.