BY TALIP AKTAS

Although the law stipulates price stability, the Central Bank changed the monetary policy and left TRY to nosedive. In brief, exports will increase by keeping TRY’s value low, the current account deficit will be met and the pressure on TRY will be removed as foreign exchange (FX) demand will decrease. Thus, inflation will decline with TRY appreciation. There is no economic theory to decrease inflation with this model.

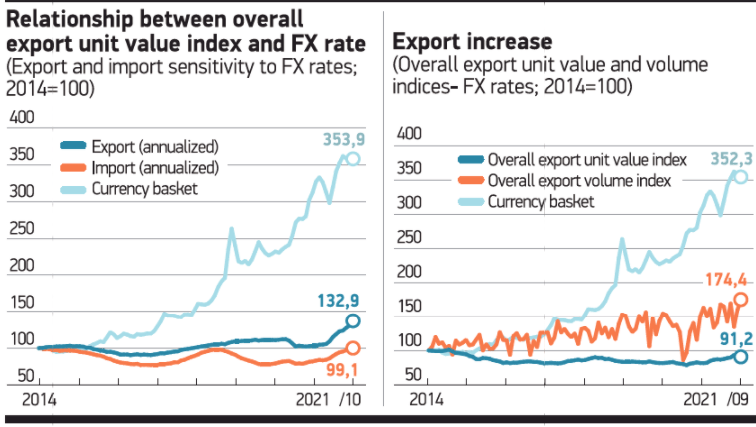

But supporting exports by keeping the national currency low is possible under certain conditions. The currency basket reached 354 in October 2021 while the overall export unit value index stood at 133. The currency basket surged by 254% while Turkey’s total exports rose by 33% in the last eight years. Accordingly, an average of each 7.7 unit increase in FX rate, raised exports by one unit between January 2014-October 2021. Turkey had to sell more products to earn this export revenue. The overall export unit value index dropped by 9% in September 2021, compared to January 2014, while the overall export volume index rose by 60% in August and by over 70% in September. The devaluated TRY created a restrictive impact on imports beyond raising exports. The annualized import fell from USD 261bn to USD 259bn in this period. The contribution of TRY, which is kept lower, to exports is controversial. But the value-added created by Turkey is transferred abroad at a low price.