BY TALIP AKTAS

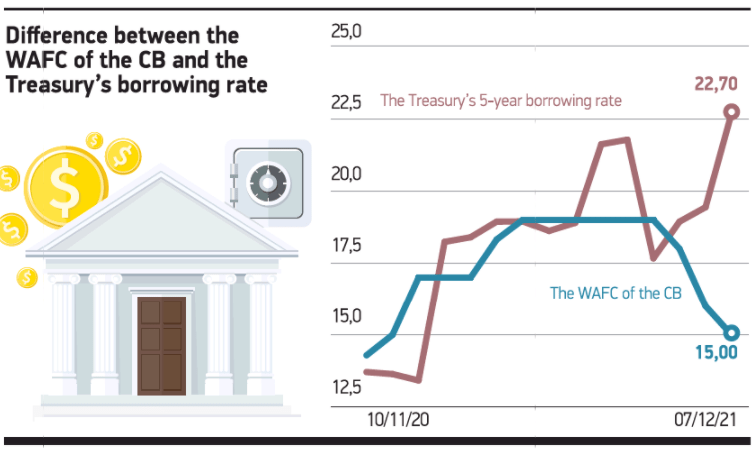

The government has funded banks with negative interest rates and met the borrowing need by paying higher interest rates for this funding for three months. The Central Bank (CB) lowered the policy rate by four points between September and November. The average compound interest rate (CIR) of the Treasury’s 5-year bond issuance was 17.67% at the beginning of September when the policy rate stood at 19%.

The Treasury was borrowing at a cost below the interest rate of banks funded by the CB. The picture has started to deteriorate since September 9. The average CIR of the Treasury’s 5-year bond issuance was 18.94% after the CB reduced the policy rate to 18% on September 24. The Treasury held an auction for the debt securities with the same maturity on November 11, and the average CIR was 19.44%. The policy rate was reduced to 15% on November 19. The average CIR rose to 22.7% at the Treasury’s auction for a 5-year bond held after November 19. The policy rate at the CB’s last three meetings and the Weighted Average Cost of the CB Funding Rate (WAFC) was reduced by four points, while the Treasury’s borrowing rate from banks funded by the CB rose by five points.