BY TALIP AKTAS

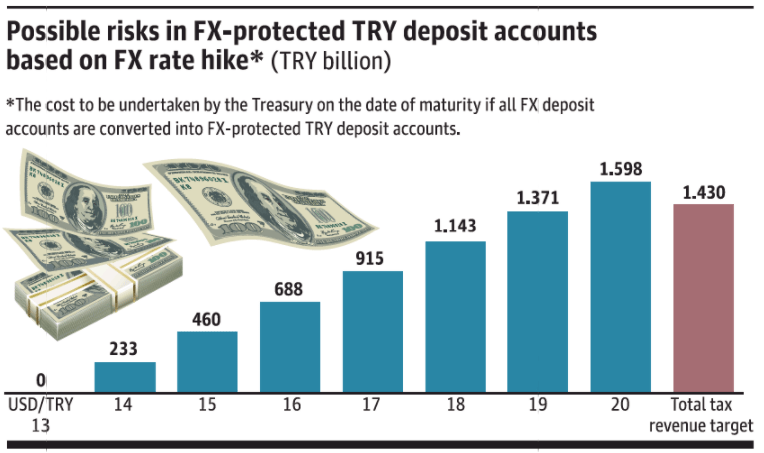

How will the Treasury meet the cost if the Foreign Exchange (FX)-protected TRY deposit accounts draw interest within the next three months. The total deposit accounts hovered around TRY 5.19tr on January 1, according to the Central Bank. TRY 4.9tr is held by real and legal persons residing in Turkey. 60% of this figure consists of FX, which totals USD 237.07bn, or TRY 3.07tr. Let’s express all FX deposit accounts at banks in USD, say the FX-protected TRY deposit account created 100% trust and residents and domestic firms changed all their deposit accounts exceeding USD 237bn into the 3-month maturity FX-protected TRY deposit accounts at USD/TRY 13.00, which was declared as the rate as of January 1. If FX rates remain steady on March 30, the date of maturity, the implementation will be 100% successful. But what if USD/ TRY hits 19.00, the interest rate cost to be undertaken by the Treasury due to its FX rate guarantee will reach TRY 1.37tr, which almost equals to the 2022 budget of TRY 1.43tr. This instrument, which can be successful in the periods when FX rates, inflation, and risks are low, poses an extreme risk under current conditions.