BY FATIH OZATAY

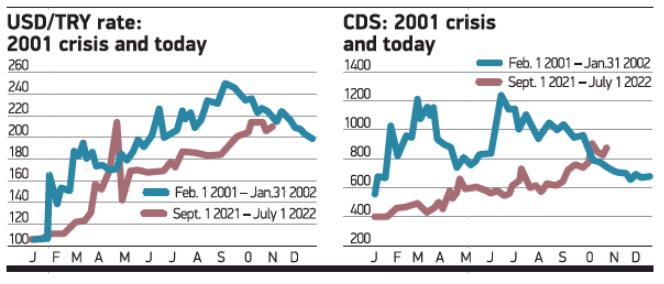

When comparing the current exchange rate and Credit default swap (CDS) premium with the 2001 crisis period, I used February 1, 2001January 31, 2022 and September 1, 2021-7 July 2022 because the 2001 crisis broke out towards the end of February. The first reason that the period ended in January 2002 is that it was the month when inflation reached its peak. The reason for the start of the second period in September 2021 is that the interest rate cut process that triggered the crisis we are experiencing started that month. The first chart shows the movements of the dollar rate. For the exchange rate comparison, it is necessary to pay special attention to the following point: except for the first few weeks of the period after the 2001 crisis, the Central Bank did not intervene in the exchange rate. However, now there is news in the press that there is an intense ongoing intervention. Despite all the foreign exchange sales, the level of the dollar rate is the same as the level reached at the end of the first tenth month of the 2001 crisis. The level we have reached in terms of the risk premium in the second graph is higher today than the 2001 crisis.