BY FATIH OZATAY

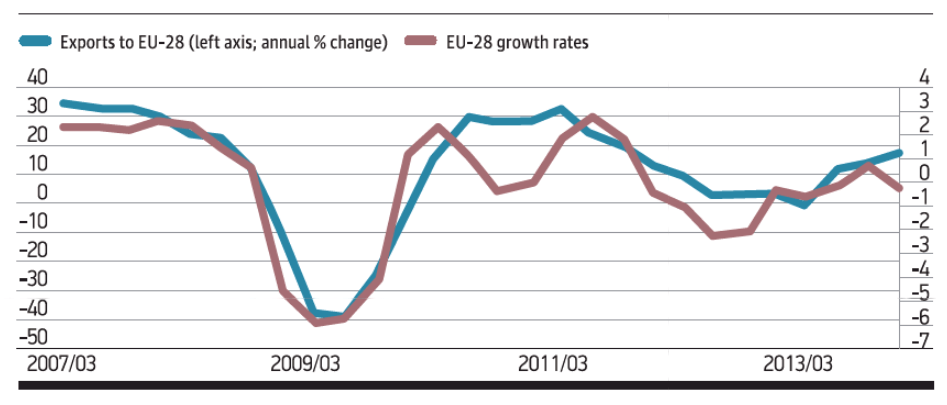

Turkey’s exports reached USD 246bn in a year as of June. The European Union (EU) and the UK, or the former EU-28, have the highest share of Turkey’s total exports. The 10-year average of its share is 44.4% of Turkey’s total exports. The economic activity volume in EU-28 is a determinant of their demand for goods. The economy of EU-28 contracted twice between Q1 2007 and Q3 2013: after the global crisis and during the European crisis. There is a close relationship between the change in Turkey’s exports to the EU-28 and the growth of the EU-28. These go in the same direction. The possibility of a recession is high in Europe. This isn’t good for Turkey as it must pay a USD 182.5bn external debt of which maturity will come within a year. The current account deficit (CAD) to be added to this debt must also be financed. Such a development, which can raise the CAD, won’t be good in a period when Turkey’s risk and therefore the cost of new external borrowing is high. Financing the CAD and increasing FX (foreign exchange) demand is at the top of the government’s agenda. Efforts to limit the demand for FX have been limited to macro prudential measures. However, these just increase issues and make matters worse.