BY UFUK KORCAN

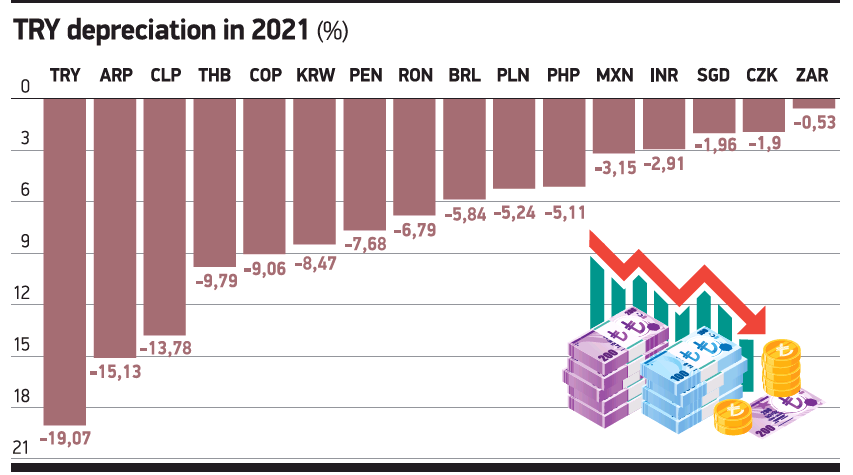

USD/TRY exceeded 9.20 with three dismissals and appointments at the Central Bank (CB) and increasing interest rate cut expectations. The upward trend in the USD/TRY started on the day CBRT Governor Naci Agbal was replaced by Sahap Kavcioglu. Starting from 7.20, it rose steadily for all but one month. The CBRT’s 100 basis point interest rate cut in September accelerated the upward momentum, jumping from 8.30 before the decision by more than 10%. New dismissals and appointments following Kavcioglu’s meeting with President Recep Tayyip Erdogan on October 13 accelerated purchases in USD. Concerns over the interest rate being lowered above expectations at the upcoming Monetary Policy Committee meeting on October 21 created adverse pressure on foreign exchange (FX) markets. Markets have included a 50 basis point interest rate cut in prices. If the PPK decides to reduce the policy rate by 100 basis, USD/TRY may hit 9.50, according experts. USD/TRY may see 9.25-9.30 in case of a 75-basis point cut. FX rates may fall below TRY 9.00 again if the interest rate is kept steady. In case the interest rate cut continues over the remaining months of the year, FX rates may end the year between TRY 9.50-10.00.