BY TALIP AKTAS

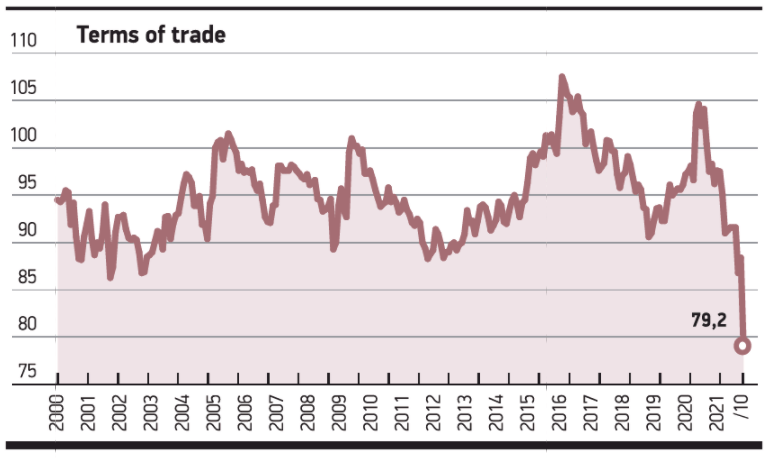

Exports have been rising since the beginning of the year. This surge doesn’t have a strong link with the value of TRY, though the two have coincided in recent months. TRY devaluation has accelerated since the Central Bank performed its first interest rate cut on September 24. The export increase stems from the freight crisis due to the pandemic and Turkey’s salient supply advantages. Part of the delayed demand has shifted to Turkey in this period. 12-month exports have surged by 29% to USD 215.6bn as of October. The pandemic-driven high base effect and hike in commodity prices on this surge should be pointed out. Annual imports rose by 21% to USD 259bn. The overall export unit value index increased by 12% from 94 to 105.2 in October on an annual basis. The overall export volume index climbed by 7.3% from 146 to 157 in the same period. The overall import volume index dropped by 18.8%, however, the overall import unit value index, or import prices, rose by 39%. These figures change the profitability picture. The terms of trade (TOT) decreased by nearly 19% from 98 to 79 in October on an annual basis. Considering the data from the last 30 years, the last time Turkey saw such low levels of TOT was during the 1994 currency crisis.