BY TALIP AKTAS

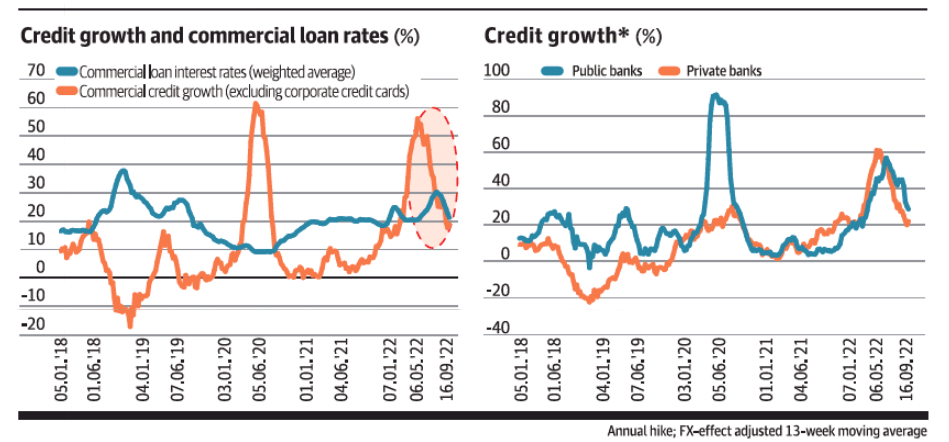

Despite a 10-point decline in interest rates, the annual growth of commercial loans contracted from 50% to below 20% in September, compared to the beginning of the year, in an environment where producer inflation hit 144% and consumer inflation reached 80%. Why have loans fallen sharply despite a negative real interest rate (IR) of over 60%? High inflation, rising costs, erosion, and uncertainty in household purchasing power have led to a significant slowdown in economic activities since the beginning of the last quarter. This along with increasing market risks pressured loans on the supply and demand sides. The cost of commercial loans, excluding agricultural loans, SME loans, exports, and investment loans, was raised for banks. The Central Bank (CB) increased required reserve ratios and the Banking Regulation and Supervision Agency (BDDK) raised risk weights. Per the criteria set by BDDK, loan restriction was imposed on companies with FX assets whose balance sheet wasn’t audited independently. The CB initiated a covert IR limitation implementation for loans. Opportunities for public banks to provide loans declined after the Treasury’s borrowing and financing need increased and external financing costs jumped.