BY TALIP AKTAS

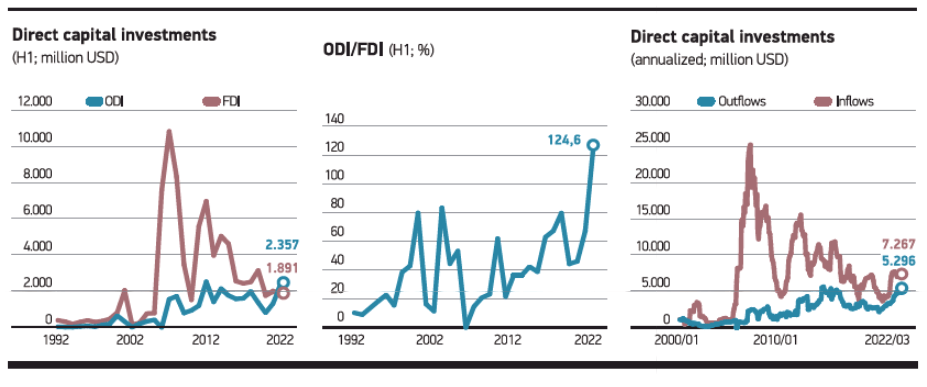

Foreign Direct Investment (FDI) in in Turkey remained below the Outward Direct Investment (ODI) for the first time in the first six months (H1) of the year. Non-residents’ direct capital investments totaled USD 1.89bn and residents’ overseas investments amounted to USD 2.36bn in January-June. The ratio of ODI to FDI, which hovered around 35% a decade ago, jumped from 67% to 125% in H1 2022, as compared to H1 2021. Liquidation of investments increased from USD 85m to USD 501m in the same period. Foreigners’ real estate investments, which totaled USD 2.2bn in H1 2021, rose to USD 3.85bn in H1 2022 and USD 6.9bn in the last 12 months. The share of foreigners on the stock exchange fell to 34% from over 70%. Their share in government debt securities fell below 1%. The figure hovered around 25% ten years ago. Portfolio outflows, which totaled USD 2.26bn in 2021, increased to USD 4.21bn in H1 2022. The biggest reason for foreign and domestic investors’ outflow from Turkey is the lack of confidence in the economy, increasing risk perception, negative return of TRY assets, and rapid TRY devaluation. Turkey, which has a capital gap, needs foreign capital.