Industrialists and exporters, who spent a year below expectations in the domestic market and exports, expect recovery from the second half of 2024 in line with the predictions that price stability will be achieved.

The year 2023 was a challenging year for both Turkey and the global economy. In a year dominated by inflationary environment, interest rate hikes and geopolitical tensions globally, Turkey spent the first half of the year with the earthquake disaster and the election atmosphere, and spent the whole year with high inflation, cost pressure and financing problems inherited from 2022.

After a stagnant 2023, there is not yet a very bright scenario for 2024. While inflation is expected to be the number one agenda item this year, the fact that the domestic market will shrink further due to tight monetary policies makes the business world nervous. On the other hand, the expectation that demand conditions in export markets, especially in the EU, Turkey’s largest trading partner, will improve in the second half, points to exports as the way out.

In 2024, real sector representatives say that access to financing, increasing export markets and qualified labor force will be priorities, and expect new steps from the economic administration to increase sectoral incentives.

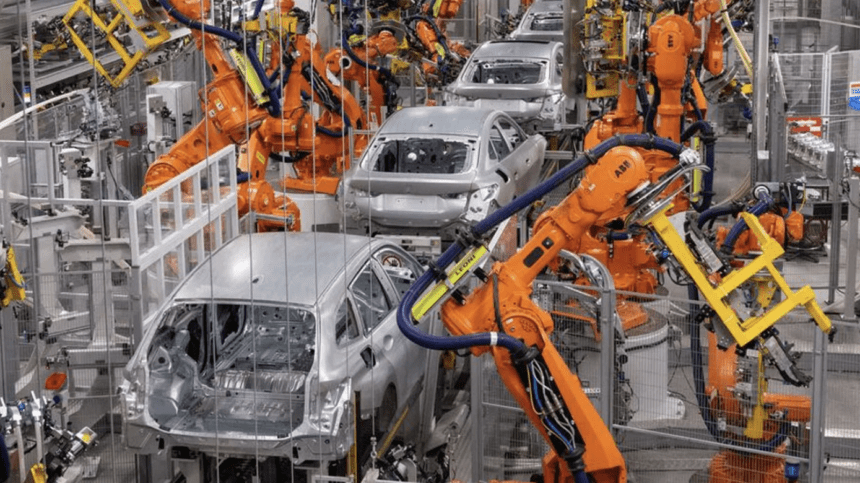

* AUTOMOTIVE

Automotive Exporters’ Association (OIB) President Baran Celik:

WE HAVE TO BE PART OF THE TRANSFORMATION

As the Turkish automotive sector, we are the leading sector of our country with 550 thousand jobs and a 15 percent share in exports. Last March, we gained an important motivation by reaching the highest exports in our history on a monthly basis with USD 3.3 billion. Finally, in November, our exports increased by 10.4 percent to USD 3.2 billion. Our January-November automotive exports also increased by 14.4 percent to USD 31,83 billion. In 2023, when we celebrate the 100th anniversary of the founding of our Republic, we were targeting a record export of USD 34 billion. By the end of the year, we will exceed this target and reach the highest export figure in the history of the Republic. In 2024, we will continue to work to contribute to the value-added exports of the national economy and to be a strong part of the global automotive industry by maintaining our export leadership. In the world automotive industry, change continues at full speed in the mobility era. It is obvious that the Turkish automotive industry must be a strong part of this transformation in order to maintain its competitiveness… Our companies must also catch up with the increasingly stringent emission standards set by the EU. If we do not take the necessary steps, we may face a carbon tax on exports to EU countries.

Automotive Industry Association (OSD) President Cengiz Eroldu:

DOMESTIC MARKET MAY CONTRACT BY 25%

2023 was a difficult year to predict for the automotive sector. In eleven months, our total production increased by 12 percent, exports by 6 percent in terms of units, 15 percent in terms of value and the domestic market grew by 59 percent. Production reached pre-pandemic levels. Automotive exports, which account for 14 percent of total exports, were the leader with USD 32.5 billion in 11 months. By the end of 2023, we expect production to exceed 1.5 million units, exports to exceed 1 million units, and the market to realize around 1.2 million units. We expect 2024 to be a challenging year for the global economy due to inflation, low growth expectations, tightened monetary policies and geopolitical tensions. From the automotive sector’s perspective, it is possible to say that 2024 marks a very uncertain and challenging period. Although postponed consumer demand is expected to have a positive impact on the market next year, variables such as rising vehicle prices, changes in consumer confidence, difficulties in transition to electrification and global economic mobility make market expectations cautious and uncertain. Considering that policies aimed at cooling the Turkish economy will be on the agenda in the domestic market in 2024, the market may contract by as much as 25 percent.

* CHEMISTRY

Istanbul Chemicals and Chemical Products Exporters’ Association (IKMIB) President Adil Pelister:

“WE PLAN FURTHER EXPANSION IN FOREIGN MARKETS”

As a sector, we anticipate that we will complete the year with a figure close to 31 billion dollars. There may be a loss of around 8-9 percent compared to 2022. Our Minister of Treasury and Finance stated that there will be a demand contraction in the domestic market and advised industrialists to take measures to diversify and expand the export market. We are planning further expansion through trade delegations and fair participation organizations in order to diversify foreign markets in our sector. One of our most important agenda items in 2024 is green transformation and sustainability. As Turkey’s second-largest exporter, we have set our 2024 export target as USD 35 billion, with a share of 13 percent of the country’s exports.

* READY-TO-WEAR

Istanbul Ready-to-Wear and Apparel Exporters’ Association (İHKİB) President Mustafa Gultepe:

CONTRACTION IN EXPORTS REFLECTED NEGATIVELY ON EMPLOYMENT

We produce in 35 thousand enterprises in 81 provinces. Our fashion industry, which ranks in the top three among the sectors with the highest exports, ranks third in value-added exports after jewelry and defense industry. We are the sixth largest supplier in the world and the third largest in the European Union. We realize approximately 3.5 percent of global apparel exports. We closed 2022 with a record export of USD 21.2 billion. However, as of the last quarter of 2022, we started to feel the negative effects of the slowdown in demand in our largest markets, the EU and the USA, and we fell behind our expectations in 2023. We completed the January-November period with exports of USD 17.8 billion. In 11 months, exports stand at 15.4 percent less in quantity and 8.6 percent less in value compared to last year. We anticipate that we will complete the year with exports of USD 19.3 billion. The contraction in exports also had a negative impact on our employment. We lost approximately 85 thousand jobs in the January-September period. We anticipate that the first positive reflections of the revival we expect in demand as of the second half of 2024 will be seen in the fashion industry, and that we will complete the year with exports of over USD 20 billion.

* STEEL

Steel Exporters’ Association (ÇİB) President Adnan Aslan:

DUMPED IMPORTS MUST BE PREVENTED

In 2024, we will be involved in projects and studies that will increase the market share of our sector. We aim to export 15 million tons in 2024. We demand that measures be taken to prevent dumped imports so that our domestic producers are not deprived of the chance to compete. In addition, as a sector that uses energy intensively in production, the share of energy in our production costs is very high. As in the UK and the EU, we expect support with incentive packages in energy. We will follow the initiatives to be provided with the support of our government in order to realize different investments in raw materials. Training qualified personnel needed in our sector is among our priorities. In this direction, we will continue to support the construction of vocational high schools in provinces where our industry is developed.

* NON-FERROUS METALS

Istanbul Ferrous and Non-Ferrous Metals Exporters’ Association (İDDMİB) President Cetin Tecdelioğlu:

WE WILL FOCUS ON INCREASING ADDED VALUE IN EXPORTS

As İDDMİB, we will continue to carry out our activities that benefit our sector in 2024, while pursuing new projects that will create a driving force for the sector. While the rules of trade are changing rapidly, we will continue to promote our Trade365 project, which provides 24/7 access to the products of our exporter companies, at every fair and event we go to in order for our sector to keep pace with the information and technology age. In this period when high-tech products gain importance in order to increase value-added exports, we will focus on the adaptation of our industry to these products.

* TEXTILE

Istanbul Textile and Raw Materials Exporters’ Association (İTHİB) President Ahmet Oksuz:

WE CONSIDER 2023 AS A LOST YEAR

As the Turkish textile industry, we were aiming to complete 2023 with USD 13 billion of exports as in the previous year, but global trade passes through a narrow corridor. The earthquake disaster we experienced in February affected our sector considerably. We consider 2023 as a lost year due to the great destruction caused by the earthquake centered in Kahramanmaras, the distinguished city of our sector. The decline in our textile sector exports is around 10 percent. However, the rate of decline in the textile imports of the EU and the USA, our largest export markets, is much higher. Despite the 20 percent decline in textile imports of EU countries and the USA, we are happy to be able to maintain our share in these markets. We anticipate that we will be able to make up for our losses, especially starting from the second half of the year, by realizing a much stronger export attack in 2024.

* WHITE GOODS

Turkish White Goods Manufacturers’ Association (TÜRKBESD) President Gokhan Sigin:

CONJUNCTURE MAY ALSO HAVE A NEGATIVE IMPACT ON 2024

More exports were made in the last 5 years compared to the previous 10 years, but in 2023, the domestic market was generally buoyant and exports were low. In the January-November period of 2023, our domestic sales increased by 15 percent compared to the same period last year. In contrast, our exports decreased by 11 percent. Domestic market dynamism was the driving force of our sector. However, in order to maintain our competitiveness in foreign markets, it has become more and more important for our sector to maintain its domestic market dynamism, production and employment structure. Due to the global conjuncture, we experienced a contraction in exports throughout 2023, and there is a possibility that this conjuncture will also affect 2024. The way to prevent the decrease in exports from having a negative impact on production is to utilize the leverage effect of the domestic market. Policies on flat steel are among the first issues followed by the white goods sector. We are closely following the anti-dumping investigation against China, Russia and India. We anticipate that the regulations that will cause cost increases will negatively affect production due to price increases. We firmly believe that the effects of foreign market competition, employment and inflation on our industry will be sensitively taken into account in the evaluation to be made as a result of the investigation.

* PLASTIC

Turkish Plastic Industrialists Research, Development and Education Foundation (PAGEV) President Yavuz Eroglu:

WE AIM FOR DOUBLE DIGIT GROWTH IN THE NEW YEAR

In 2024, we think we are luckier than other sectors in the domestic market. Because the demand for plastics is increasing as it is cheaper than alternative products such as glass, metal and wood due to reasons such as high inflation and recession. The Turkish plastics industry annually produces 11 million tons of plastic products from original polymers. When we look at this production in terms of turnover, it exceeds USD 45 billion annually. When we take into account 1.5 million tons of plastic products produced from recycled raw materials, we reach a total turnover of USD 50 billion. Our sector is one of Turkey’s most exporting industries with direct and indirect exports of USD 15 billion. In this context, we anticipate that our exports will increase in 2024, and we aim for double-digit growth.

* FOOD

Istanbul Cereals, Pulses, Oil Seeds and Products Exporters’ Association (İHBİR) President Kazim Tayci:

INVESTMENT ENVIRONMENT SHOULD BE CREATED IN THE FOOD SECTOR

The cereals, pulses, oil seeds and products sector grew by 8.73 percent in 11 months of 2023. In 2024, apart from price competition, we plan to increase our exports with innovative products, branding and the right products without the need for exchange rate expectations. We need to ensure market diversity in exports. If the environment for investment in the food sector is created, we can see our exports increase more in a few years. The decisions taken by our authority regarding our agricultural production were very accurate. The planting of uncultivated areas and the support given to farmers revitalized production. The favorable progress of climatic conditions increased the production of our sector to record levels. The support policies recently given to farmers should be continued with the same determination.

* FOOTWEAR

Turkey Footwear Manufacturers Association President (TASD) Berke Icten:

CONTRACTION MAY CONTINUE IN THE FIRST 6 MONTHS

2023 was difficult for our footwear industry. Demand for shoes contracted in global markets. On top of that, despite high cost increases, we had difficulty in keeping prices due to the horizontal course of the exchange rate and lost some of our customers who came during the pandemic period. When we look at the 11-month data, we are 25 percent behind in terms of units and 5 percent in value compared to last year. We had factory closings and employment losses. Since the beginning of the year, we have lost about 30 percent of our employment. In addition to market losses, we also faced an extraordinary increase in imported shoes. Because despite the existing customs duties and protection measures, some shoes can be imported from Asia at a much more affordable price than the cost of production in Turkey. Following a surplus of USD 500 million in footwear foreign trade, unfortunately we started to run a deficit again after 6 years. When we look at the past 11 months, we see that we have a current account deficit of around 100 million dollars. The contraction continues in important markets, especially in the EU and the USA. We anticipate that this situation will not change for at least 6 months.

* RETAIL

United Brands Association (BMD) President Sinan Oncel:

PRICES ARE NO LONGER ATTRACTIVE FOR FOREIGNERS EITHER

Although we did not reach the expected volume in tourist shopping last year, it was a productive year for the organized retail sector except for September and October. Domestic customers brought their needs shopping forward due to concerns that prices would increase further in a high inflation environment. Since everyone utilized their savings by shopping as much as their means allowed, most of our brands increased their unit sales. We can say that there was an average increase of 10 percent in units and 100 percent in turnover throughout 2023. Sales to tourists have an important place in the turnover of organized retail. In some shopping malls in touristic centers such as Istanbul, Antalya and Bodrum, more than half of the turnover is generated from sales to foreigners. According to BKM data, sales to foreigners accounted for approximately 10 percent of total card expenditures in 2022. In the January-October period this year, this rate remained at 7 percent. This shows us that prices in Turkey are no longer attractive for foreigners, let alone domestic customers. As we enter 2024, we are optimistic and look to the future with hope, because organized retail is a dynamic sector. This year, the performance of organized retail will be determined by the level of cost increases, especially rent and personnel expenses, the purchasing power of consumers and tourist shopping. First of all, we need to break the expectation that ‘prices will increase further’, and for this, the economic administration has an important role.