BY ISMET OZKUL

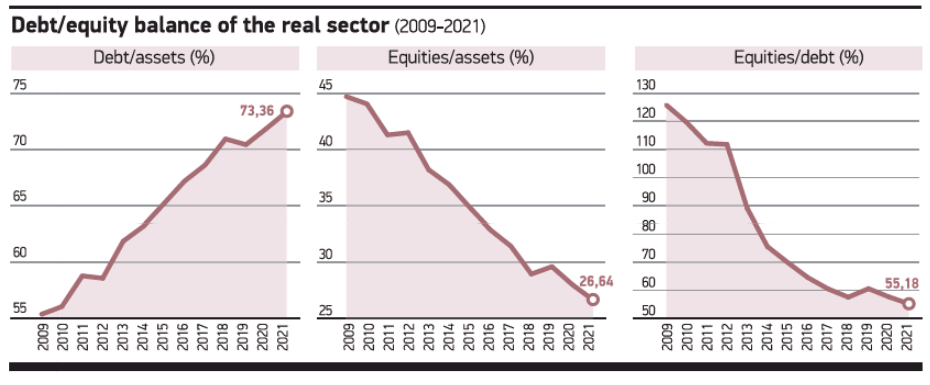

The real sector’s assets correspond to 26.64% of total resources and debts have reached 73.36% of all resources as of 2021, according to the sectoral balance sheet data prepared jointly by the Central Bank and TurkStat. The sector’s equities can only meet 55.18% of its debt. The deterioration tendency in the equities/debt balance is now chronic. 44.7% and 55.4% of the sector’s total resources consisted of equities and debts, respectively, in 2009. The share of debts in resources rose by 18 points and the share of equities in resources dropped at the same level over the past 13 years. The debt coverage ratio of equities fell by 70 points from 126% to 71% from 2009-2021. The long-term debt coverage ratio of the sector’s tangible assets declined by 101 points from 227% to 126% and the total debt coverage ratio of the sector’s real assets fell by 33 points from 85% to 52% in 2009-2021. The fault line in the balance sheet of the real sector has been revealed and tension is increasing. The deterioration in external balances and dried-up external resources create additional pressure. The low debt coverage ratio of assets increases the risk of the chain reaction of the economic earthquake.