BY SEBNEM TURHAN

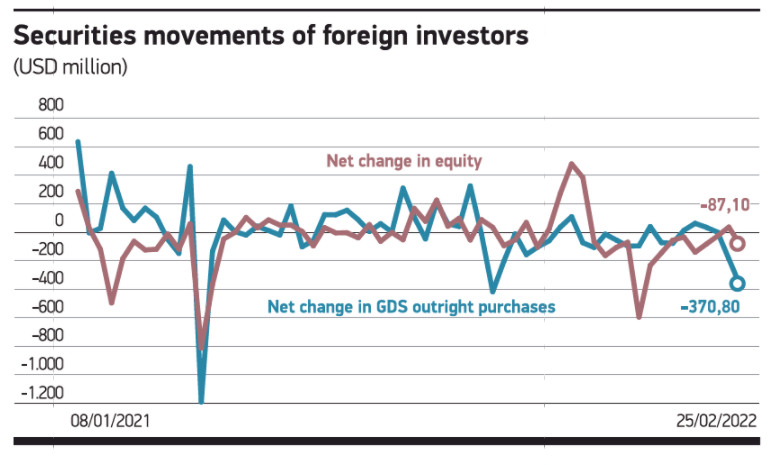

Increasing import costs due to the Russia-Ukraine war, interventions to keep TRY steady, company import payments, and the Central Bank’s (CB) foreign exchange (FX) sales all raised the need for FX. A lack of foreign direct investment in Turkey has caused insufficient supply. Ongoing high FX demand and the absence of supply created an FX squeeze in the market. Equity sales from foreign investors totaled nearly USD 9bn in the last four years. Their net equity sales amounted to USD 526m in January-February alone. Their share in government debt securities (GDS) fell to 3.5% in recent years. Their net GDS sales reached USD 556m in the last two weeks. Turkey’s energy import-driven foreign trade deficit already totaled USD 18bn in January-February. Every USD 10 hike in oil prices creates a USD 5bn surge in Turkey’s current account deficit. This causes FX demand to increase. The public and private sectors’ external payments total USD 63.8bn in 2022. Record FX sales of USD 5.37bn were made to the state economic enterprises (KIT) in February, according to the CB. USD 15.1bn of the KITs’ FX demand was met from the CB’s reserves in the last four months. The CB’s FX sales are expected to accelerate due to surging energy costs. All of these factors have raised the FX need and created an FX squeeze in the market.