BY MEHMET KAYA

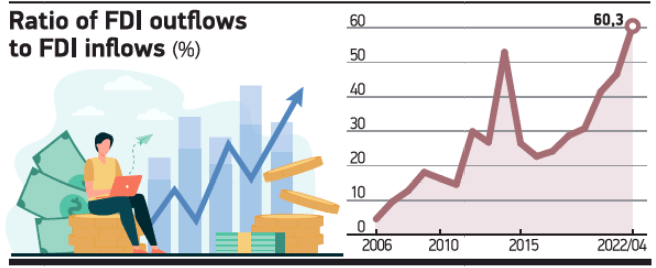

Foreign direct investment (FDI) inflows to Turkey are slowing, while FDI outflows from Turkey continue to surge. The net FDI inflow to the country fell by 31% from USD 1.47bn to USD 1.01bn in January-April, year-over-year, according to the Central Bank. The net FDI inflow to Turkey from capital and real estate items reached USD 2.54bn in January-April. Real estate investments generated USD 1.68bn of the figure. Overseas investments from Turkey, meanwhile, reached USD 1.53bn in the same period. The ratio of FDI outflows to FDI inflows, which was 41.4% in 2020 and 46.5% in 2021, rose to 60.3% in JanuaryApril. The annualized data reached 49%. The low level of FDI inflows to Turkey seems to be permanent following COVID-19, as the net FDI inflow remained below the figure in the peak pandemic year of 2021. Direct investments from Turkey to abroad, which have shown an upward trend over the years, continue to be high. USD 1.3bn investment was made from abroad to Turkey in January-April while the outflow totaled USD 462m. The net capital inflow, including other capital inflows such as borrowing, reached USD 847m. Considering an outflow of USD 1.53bn from Turkey, the net foreign capital inflow amounted to USD 1.03bn within the scope of the balance of payments.