BY ALAATTIN AKTAS

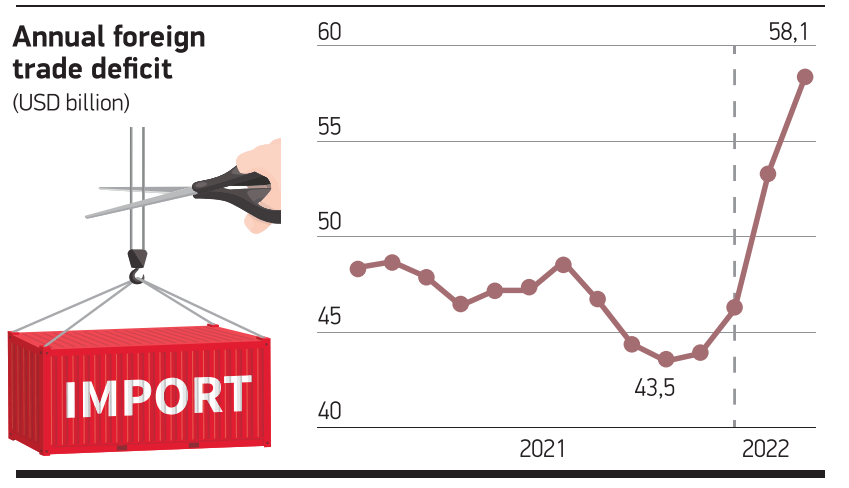

Turkey’s annual foreign trade deficit (FTD), which totaled USD 43.5bn in October 2021, rose to USD 58.1bn in February. The monthly FTD, which stood at USD 3.1bn in January 2021, jumped to USD 10.3bn in January 2022. The monthly FTD rose from USD 3.3bn to USD 8.1bn in February year on year. The FTD, which totaled USD 6.4bn in January to February of 2021, hit USD 18.4bn in January to February of 2022. The reason behind this increase is only known by our ministers and politicians. Let’s stop pointing out that exports are breaking records. Energy prices are surging around the world. Crude oil and natural gas prices are raising individuals’ bills. Agricultural product prices are at an all-time high. Do those who have made Turkey rely heavily on imported agricultural products over the years regret their actions and policies? Depending on the length of the Russia-Ukraine war, we’ll have to pay more money for the same amount of imports. That’s why the FTD will continue to surge. Moreover, foreign exchange (FX) won’t flow into Turkey as expected. Tourism revenues won’t reach the expected level even if the war ends. Turkey’s imports will rise, and the FX need will increase, while FX revenues will decline. That’s why we should have strong FX reserves. However, we are selling FX to the market to hold FX rates steady, while obfuscating how much FX is being sold.