BY ALAATTIN AKTAS

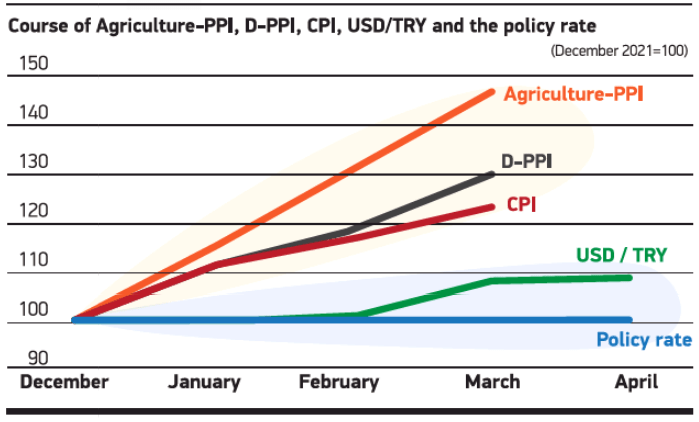

The Consumer Price Index (CPI) rose by nearly 14% and exceeded 36% annually, while the domestic producer price index (D-PPI) surpassed 19% monthly and reached 80% annually in December 2021. So, how can we start 2022 with a clean slate? By stopping the foreign exchange (FX) rate increase and not changing the interest rate. The FX rate hike has been held down with short-term methods such as the FX-protected TRY deposit account. The interest rate is steady. But the result is frustration! The price hike can’t be held. It is believed that the price hike will be stopped when FX rates and policy rate are held. It’s not that easy. The difference between the interest rate, FX rates, and prices continues to increase. The aftershocks from the FX rate hike can’t be gotten rid of in a short period of time. Moreover, a self-reinforcing price mechanism has emerged. The surge in CPI this year is quite below the hike in agricultural producer prices, the engine of the price surge, and D-PPI. This gap, which won’t be fullyclosed, will narrow. The difference between indices doesn’t include data from the first quarter of 2022. A significant difference has emerged over the last year. There is a war, which had to be included in the data. The Federal Reserve will raise the interest rate – we’re still watching this. Also, more serious measures will not be announced until the election.