BY ALAATTIN AKTAS

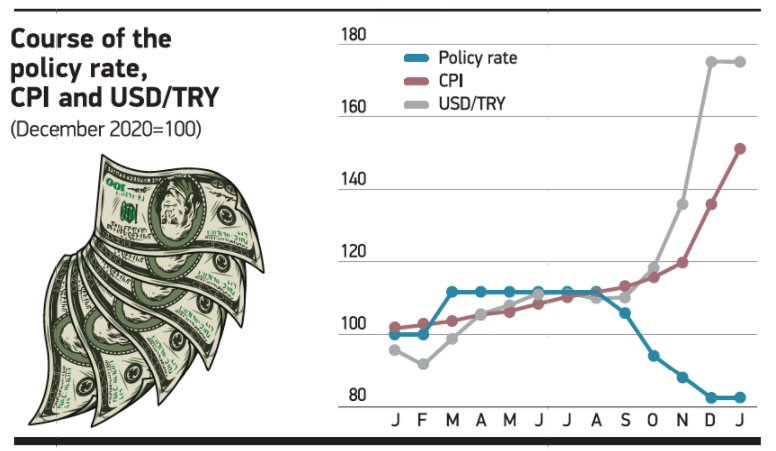

The Central Bank (CB) kept the policy rate steady at 14%. Even though they chose not to cut rates further, we are still suffering from the policy rate cut from 19% to 14%. The policy rate, Consumer Price Index (CPI), and USD/TRY had almost parallel courses in the first eight months of 2021. However, this changed following the interest rate cut in September 2021. The policy rate, which was 100 in December 2020, was 82 by January 2022. The CPI, which stood at 100 in December 2020, rose to 151 by January 2022. USD/TRY, which hovered around 100, hit 175 in January 2022. The starting point for all three indicators was 100. But now, the policy rate, CPI and USD/ TRY are 82, 151 and 175, respectively. USD/TRY and CPI jumped after we reduced the interest rate, which we consider the cause of inflation. The price surge is still below the foreign exchange rate increase. The gap will gradually close. Why didn’t you lower the interest rate if, you say, inflation decreases when it falls? Since, according to your theory, the policy rate cut is a means of reducing inflation, who or what prevented the interest rate cut in February? Let the CB reduce the interest rate so as to not have to impose a valueadded tax (VAT) reduction at the cost of tax revenues to fight against inflation. Reduce the interest rate so that we don’t introduce ‘new packages to fight against inflation’ once every three to five months, trying to craft new regulations for increasing electricity prices despite a decreasing policy rate. Let’s reduce the interest rate further and cut corners. If we believe this will work, why are we trying so hard to counter it?