BY BADER ARSLAN

RECORD IN EXPORTS AND IMPORTS

Turkey’s exports increased by 19.8% in March to USD 22.7bn, according to provisional data announced by the Ministry of Commerce. Imports increased by 31%, data showed. Both exports and imports reached their highest levels ever.

These data closed out the first quarter of the year. The three-month increase has reached 20.8% in exports and 42.1% in imports. Since the increase in imports is almost twice that of exports, we reached a level beyond the estimates for the foreign trade deficit, with USD 26.4bn in the first quarter.

The growth in imports and the foreign trade deficit is based on the leap in our energy and metal imports. Our energy imports amounted to USD 25.3bn in the first quarter of the year. The deficit in the same period last year was USD 8.7bn. Turkey has been making the highest energy imports in its history in recent months due to rising oil and gas prices. With the effect of the increase in exchange rates, these increases in the domestic market are reflected to a greater extent on natural gas and fuel prices.

The high increases in our imports of plastic, iron-steel, aluminum, cotton yarn, and paper in the first three months of the year are also noteworthy. We are seeing below-average increases or decreases in product items such as motor land vehicles, electrical machinery, non-electric machinery, copper, pharmaceuticals, and grains.

The iron and steel industry has a high contribution to both exports and imports. The sector’s exports increased by more than 50% in the first month of the year. Aluminum exports are 84% higher than last year. We also see an increase of nearly 40% in ready-made clothing exports. On the contrary, there are more moderate rises in electrical and non-electric machines. A decrease of 3.3% is striking in the automotive sector, which is our biggest export item.

The common feature of both the exports and imports is that the increase does not spread over the base. On both sides, the rise in global prices lies at the heart of the increases. Therefore, we will start to see more moderate foreign trade data when commodity prices calm down.

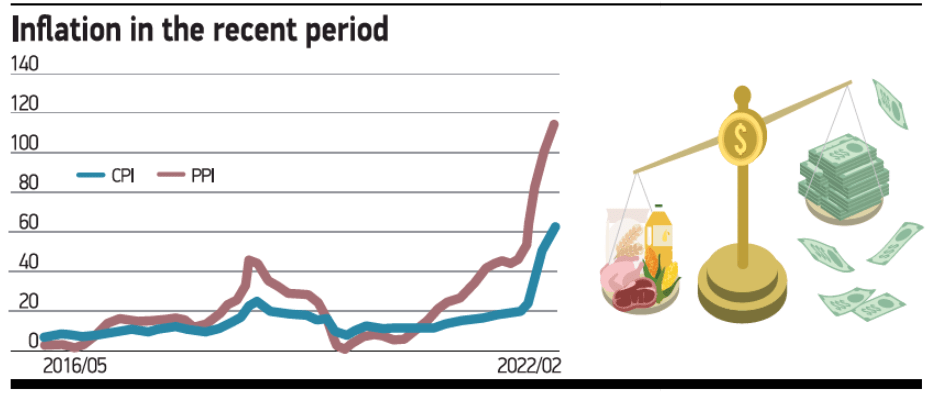

INFLATION RETURNS TO 2001

March inflation was 61.1% in consumer prices and 115% in producer prices. We’re back to levels last seen 20 years ago in both indices. (See graph: Inflation in the recent period)

The expectations were 4-5 points higher than the announced data. However, the main data came in low as food inflation was announced at an extremely surprising level of 4.7% (way lower than the real felt inflation) on a monthly basis.

The increase in CPI was 22.8% in the first three months of the year. The highest price increase in this period was in transportation at 31.7%. This was followed by alcohol and cigarettes at 27.2%, food at 25.9%, and health at 24.7%. The PPI increase in the first quarter reached 29.3%.

The difference between the PPI and CPI indices reached 53.8 points in March, breaking a record. This shows that the producer price increase will be reflected on consumer prices, although not at the same rate, in the coming months.

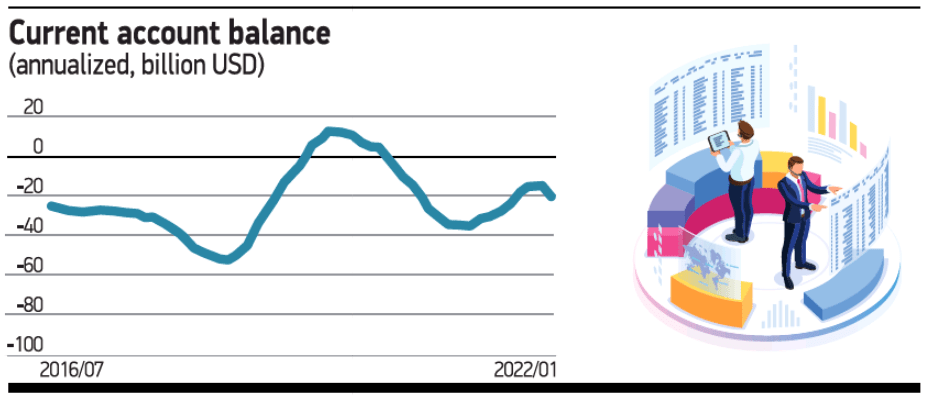

CURRENT ACCOUNT DEFICIT RISES

The first data to be announced this week is the balance of payments for February, which will be announced this morning (Monday). The current account deficit reached its highest level in the last 50 months, becoming USD 7. 1bn in January. February data to be announced this morning may be near USD 5-6bn. Foreign trade data points to a deficit of USD 6bn in March. We may see the biggest first quarter deficit since 2011 when the data is fully released. (See graph: Current account balance)

CONSTRUCTION COSTS GALLOP

The graph below assumes the construction costs in 2015 as 100 and indexes the next period accordingly. As you can see, from 2020 onwards, the rise in costs accelerates, and from 2021 it becomes abnormal. Currently, the index value has reached 464. In other words, the costs have increased by 4.6 times since 2015. Maybe not in this week’s data, but the 500-point limit will be exceeded in the March data.

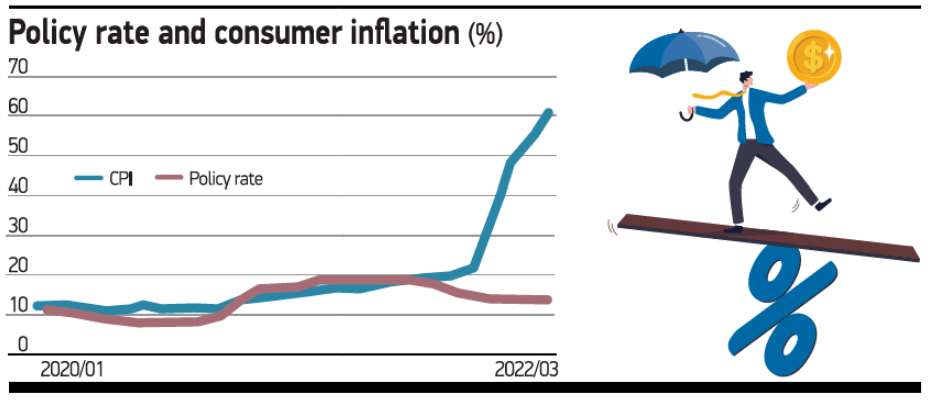

MPC’S INTEREST RATE DECISION

The interest rate decision of the Monetary Policy Committee (MPC) will be announced on Thursday at 2pm. Interest rates will likely remain steady this month.

The probability of an interest rate increase by MPC is lower than the probability of a meteor falling that day, after the words of Treasury and Finance Minister Nurettin Nebati last week, summarized as “We have overcome the exchange rate and interest rate, it’s time for inflation.” (See graph: Policy rate and consumer inflation)

The gap between inflation and interest rates continues to widen and this trend will continue in the near term. The widening of the gap means that the negative real interest rate will grow further and the pressure on the exchange rate will increase. Although there is no official statement of intervention, there is a sense that there are measures being taken so that the dollar rate does not exceed 15. We’ll see how long these efforts will continue as negative real interest rates continue to grow.