BY BADER ARSLAN

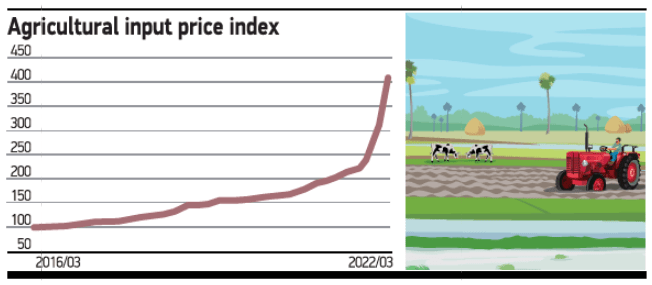

In a normal economic agenda, agricultural data does not attract much attention because it does not direct the markets. However, recently, increasing prices across the country have naturally attracted attention as they affects all socio-economic groups. Last week, TurkStat announced the agricultural input price index for March. This index measures the extent to which the inputs subject to agricultural production change production costs. When the 2015 values are accepted as 100, today’s production costs have increased to 411.5. So, costs have quadrupled. Most of this enormous increase, as you can imagine, has taken place in the recent period.

The index was 224 points in September 2021, just six months before the March data was announced last week. It has almost doubled in this period. From another perspective, more than the increase from 2015 to 2021 has occurred in the last six months.

The highest increases in costs compared to the previous March were seen in:

• Fertilizer with 228%.

• Energy and fat with 175%.

• Building maintenance with 118%.

• Animal feed with 107%.

• Agricultural pesticides with 88%. Veterinary spending rose by 31%. These data show the reasons why the costs of the food products we consume have increased. The increase in costs is reflected in the sales prices at similar rates.

FIRST QUARTER GROWTH TO BE ANNOUNCED

This week’s agenda will be set by growth data. On Tuesday morning, GDP data for the first quarter of the year will be announced. Completing last year with 11% growth, the Turkish economy is expected to continue to grow in 2022, albeit at a slower pace. In the last Medium-Term Program, 5% was targeted for annual growth, but current expectations vary between 2-4% for the year in general. However, we will see a high growth in the first quarter, with the momentum continuing from last year. The first quarter growth expectations of 15 economists who participated in Anadolu Agency’s expectations survey range from 5.4% to 8.1%.

First quarter growth data will likely be the highest we’ll see on a quarterly basis in 2022. It is certain that the second quarter will be lower than the first quarter. Although it is not possible to make a clear prediction for the second half of the year, we can say that growth will slow down a little more if economic indicators maintain their current trends. Consumer confidence is at its bottom and other indicators for consumption have turned downwards. Indicators for the construction sector are also slowing down. On the other hand, the increase in exports, which still has positive momentum, is not enough to raise growth on its own.

We are starting June with PMI data, which will be announced on Monday morning. The PMI has had low values in recent months and it would not be a surprise if the data to be announced this week is below 50.

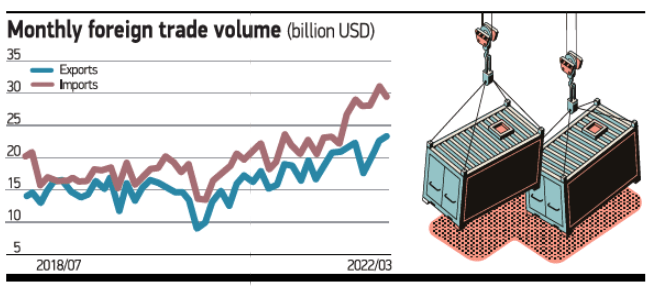

FOREIGN TRADE DATA FOR MAY

The Ministry of Commerce will announce provisional foreign trade data for May on Thursday morning. The rapid increase in both exports and imports continues. We will likely see that the similar trend sill continue in May. However, it should not be forgotten that global growth is slowly decelerating and this will be reflected in foreign trade over time. Even though foreign trade data seems lively in dollar terms due to the rise in commodity prices, foreign trade is slowing down in terms of quantity. This will also be felt in the Turkish data in the coming months.

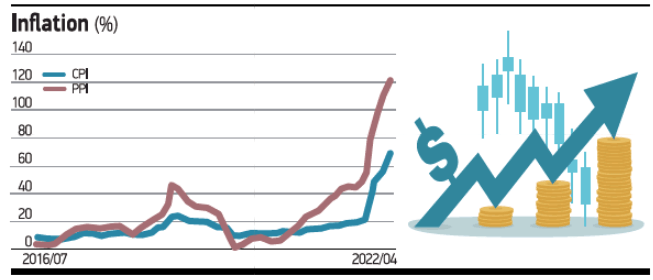

INFLATION HEADS TOWARDS THREE DIGITS

April inflation was 70% in CPI and 121.8% in PPI. The May data will be released this Friday. We will see both indices continue to rise.

In May, TRY lost more than 10% of its value. This will also be reflected in the inflation data in the coming months, and if it stays at these levels, it will probably raise prices by 3-4 points. The exchange rate effect will add fuel to the fire of inflation, which is already high and rising. The potential for global support for the recent price increases in food prices must have drawn your attention. Grain prices are expected to continue to rise in the coming months, though they have eased a little in recent weeks. As long as the Russia-Ukraine War continues, it is not possible to see a rapid decrease in prices in the short term. Additionally, the fact that India and Morocco will produce less wheat due to drought will also increase prices. Therefore, the weight of global food prices may be felt more in the course of the high inflation we will experience in the coming months.