BY ALAATTIN AKTAS

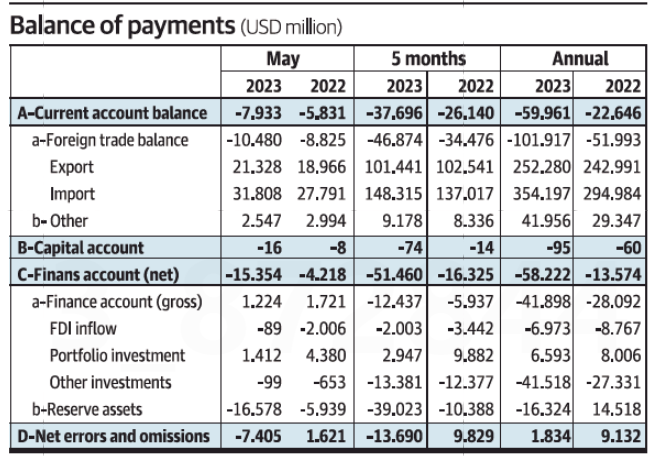

The soft belly of the Turkish economy is that it can’t earn FX and always posts a deficit. So, our problem is the balance of payments. The current account deficit (CAD) was USD 2bn higher in May 2023 than in May 2022. The 5-month CAD is USD 11.5bn above, and the annual CAD was USD 37bn higher in May 2023 than the annualized CAD in May 2022.

CAD continuously rises. It means that we find financing somehow. If financing wasn’t found, there would be no CAD.

We found financing of USD 4.2bn in May 2022 and USD 15.4bn in May 2023. There was no financing from abroad versus an outflow of USD 1.2bn from the gross financing item.

USD 16.6bn was used from the Central Bank (CB) in January-May. Was that the CB’s money? No. The CB collects FX in various ways and provides it. That’s all.

We need an FDI inflow such as investments like a new factory, new production, and new employment.

But we even try to find money by selling the last assets. Because investment from scratch means being rooted to the spot. That is why foreigners split hairs and examine the legal and justice system rather than the economic conditions in the country.

Let’s assume the previous management conducted the business and posted a CAD.

Moreover, it couldn’t find FDI and portfolio investment to finance the CAD. But there is a portfolio outflow of USD 1.4bn even in May.

FDI seems to flow a little. FDI totaled USD 2bn in January-May and USD 7bn in a year. However, USD 1.95bn and USD 6bn were the real estate purchase by foreigners, respectively. So there is no direct investment by foreigners.

We await this from the new management of the economy. What will it do to attract FDI? Or will it be able to do it?

Some conditions should emerge if it’s known that FDI doesn’t flow and portfolio investment is aimed.

For instance, foreigners want to gain while coming. So, they want a higher FX rate.

For instance, they want to gain while purchasing. So they want the interest rate higher, and therefore they want debt security prices lower.

We don’t know if we provide these. Either we provide what is desired, or we continue to finance CAD by pushing the CB resources. It’s our choice, but we don’t have many options.