BY BADER ARSLAN

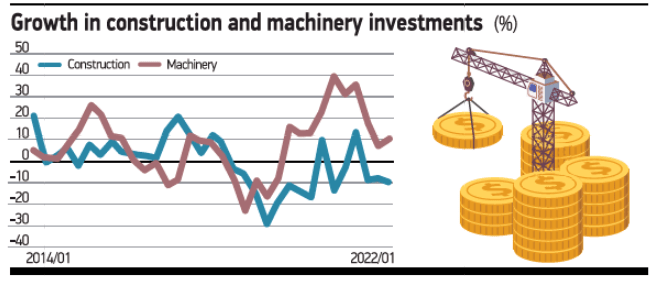

One of the striking points in the growth data announced last week was the decline in construction investments and the growth of more than 10% in machinery investments.

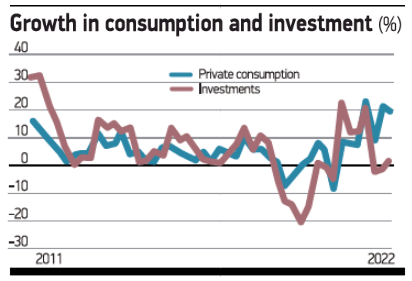

While the economy continues on its usual course, we see that consumption and investment growth are close to each other. However, from time to time, the difference between these two widens. The graph below shows the growth performance of consumption expenditures and investments in Turkey since 2011. As you can see, there is a very close relationship between the two items. The biggest divergence in the last 10 years was experienced with the rapid contraction in investments in 2019. However, the divergence since the end of 2021 is a new one. This time, there is no contraction in investments in general, but the growth rate is quite low. On the other hand, we saw that consumption increased by 19.5% in the first quarter, according to data released last week. (See graph: Growth in consumption and investment )

How can we explain the very weak investment growth while consumption expenditures are growing faster?

The main reason for the rapid increase in consumption is the loss of attractiveness of saving due to extremely low interest rates. Deposits that promise interest rates far below inflation are no longer a powerful savings tool as it used to be. FX-protected deposits, on the other hand, protect depositors against exchange rate increases, not inflation. The second reason is that capital owners invest their savings in property due to the rapid rise of inflation and expectations that it will not decrease in the near future. Those who buy more than one car or real estate for investment purposes continue to increase. A third reason is that the demands of those whose incomes decreased in real terms against inflation and who expected a further increase in prices prioritized their demands, which partially supported the consumption. Finally, with the post-pandemic normalization, we can count the increase in the demand for the services provided by restaurants, cafes, etc. as another factor that increases consumption.

Let’s get back to the investment side. Despite the 19.5% increase in consumption expenditures, investments grew by 1.1%. There are two main items of investments: construction and machinery-equipment. While construction investments contracted by 9.8% in the first quarter, machinery-equipment investments grew by 10.5%.

The graph above (see graph: Growth in construction and machinery investments) shows the growth trend in construction and machinery investments. The difference between the two has been widened in favor of machinery investments as of the beginning of 2019.

There are two remarkable points about construction investments:

1-Construction investments shrank in 13 of the last 15 quarters, grew in only two.

2-Construction investments thus declined to the level of 2013.

First of all, let’s remember this: Construction investments and housing sales should not be confused with each other. While the first is investment, the second falls under the heading of consumption.

The increase in housing prices has now moved the purchase of housing beyond being an investment. Prices rose so much that it has become impossible for a middle-income family to buy a house even at 0.99 loan rate.

This being the case, purchasing new housing became a choice for the upper income group. For this reason, the number of buyers and sellers began to decrease. In order for the housing market to revive, either housing prices need to decrease, or people’s incomes need to increase. This is unlikely any time soon. For this reason, a recovery in construction investments should not be expected in the upcoming period.

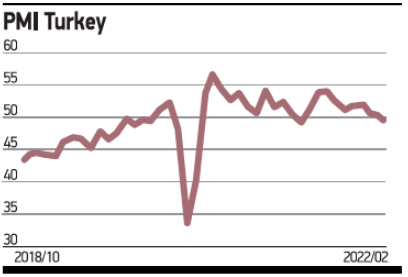

PMI REMAINS IN CONTRACTION ZONE

Last week, the PMI index was announced as 49.2 in May by the Istanbul Chamber of Industry (ISO). The index was at the same level in the previous month. Thus, the PMI remained in the contraction zone for the third month in a row.

While PMI indices increased in eight of the ten sectors analyzed within the scope of the index compared to the previous month, there was an increase in production in seven and export orders in only three of them. The main reason for the decline in the PMI index is the poor performance in the machinery and basic metals sectors. Both sectors have been contracting since the end of 2021. (See graph: PMI Turkey) Despite the developments in the domestic economy, the PMI index is supported by the increase in exports, and this prevents the index from getting weaker values. However, we may see more moderate increases in our exports in the coming months, which may cause our own PMI index to decline further.

THE DECLINE IN TL WILL BE REFLECTED ON THE REAL EXCHANGE RATE

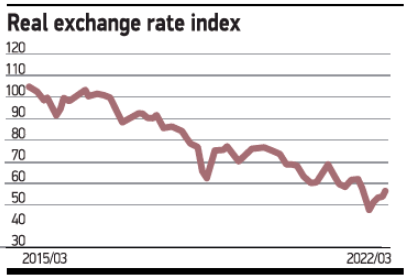

Throughout May, TL experienced a depreciation of more than 10%. We will see how this affects the real exchange rate on Monday afternoon. (See graph: Real exchange rate index) The real effective exchange rate, which fell to its lowest level ever at 47.7 in December, recovered slightly over the next three months and rose to 57 in March. This data shows that the Turkish lira is approximately 40% less valuable compared to the currencies of our trading partners, based on inflation differences between countries.

NEW PEAK AHEAD IN CONSTRUCTION COST INDEX

Construction cost index for April will be announced this week. In March, the index rose above 500, doubling compared to last year. The construction costs increased by fivefold since 2015.

(See graph: Construction cost index) The main reason for the increase in costs is the increase in exchange rates. In addition, the increase in raw material prices on a global basis also has an effect. However, the depreciation of the TL has a much greater impact than the global price increase.