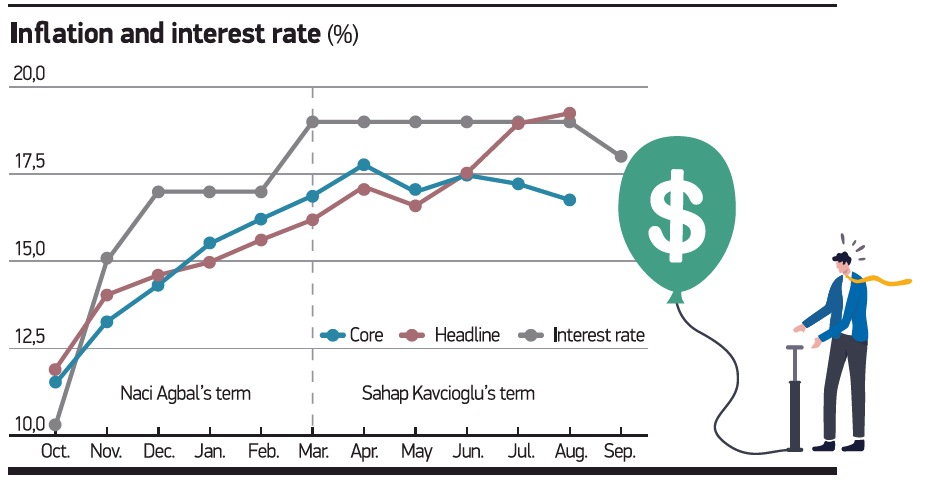

What could have led the Central Bank (CB) to reduce the interest rate in September? The interest rate, which was increased at the meeting held in March, had been kept steady at 19% for six months until September. President Erdogan’s opinion about interest rates isn’t new. Tongues were bitten after Naci Agbal was appointed the CBRT Governor in November 2020 and the interest rate was raised to 17% from 10.25% in two steps. Apparently, its increase to 19% in March was the final straw. The interest rate cut leads to economic destruction in the shortterm. Everyone, including the CBRT, expects this. The USD nearly increased by TRY 0.25 after the rate reduction. The Treasury in total has USD 136.3bn debt, including USD 103.3bn external debt and USD 33bn domestic debt. That TRY 0.25 means a 34bn increase in this debt in TRY terms. There is also a USD 128bn difference between foreign exchange assets and liabilities of real sector companies. The impact of that TRY 0.25 on this debt is TRY 32bn. This burden won’t stop there; it will reflect on prices and cause inflation. In June, Erdogan said the interest rate would be lowered in July or August, but this didn’t happen. Apparently, someone told him the inflation would to decrease, but this also didn’t happen. In this case, should we say the interest rate cut was delayed to September? Or can we say the interest rate wasn’t reduced early, on the contrary, it was delayed? It seems so.