BY ALAATTIN AKTAS

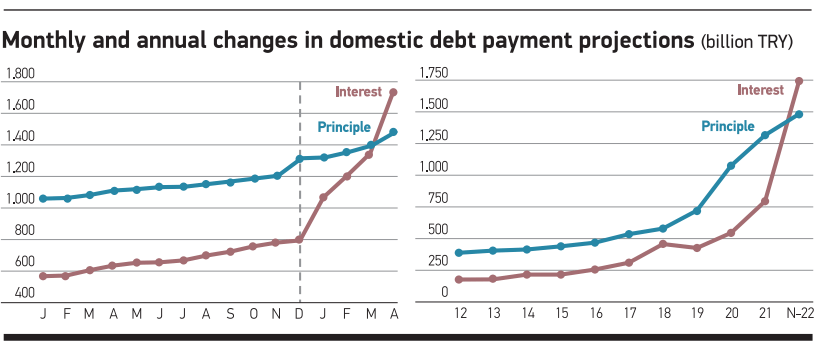

Foreign exchange (FX) rates, inflation, and interest rates for the Treasury’s borrowing jumped after the policy rate cuts. But the surge in the interest payment to be made by the Treasury on domestic debt has paved the way for a balance change. It has exceeded the principal amount. The Treasury will make a TRY 1.5tr principal amount payment in line with the debt stock in April. The interest payment will reach TRY 1.7tr. This result was inevitable after the Treasury primarily gave weight to floating rate and FX indexed bonds in recent years. The domestic debt to be paid by the Treasury was TRY 1.3tr in December. The amount was TRY 1.5tr with monthly limited increases in April. That is a 13% surge! The interest payment on the domestic debt rose by TRY 795bn to TRY 1.7tr in this period. That is 119%! The Treasury will make a TRY 1.7tr interest payment on domestic debt even if it doesn’t borrow by April at all. The annual surge is 174%. What has Turkey done to increase this interest payment burden, which stood at TRY 635bn in April 2021, by TRY 1.1tr to TRY 1.7tr in April 2022? If the interest payment burden had increased as much as the principal debt, the surge would have been around TRY 184bn. But the increase in our debt is TRY 1.1tr. Interest payment on the domestic debt rose by TRY 925bn due to wrongly taken steps.