BY BADER ARSLAN

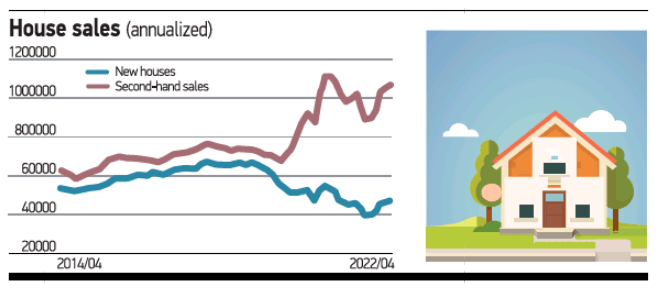

In April, 133,508 houses were sold throughout Turkey, according to the data released last week. About 36,000 of them were new residences and 96,000 of them were second-hand residences.

The picture of the housing market tells us the following:

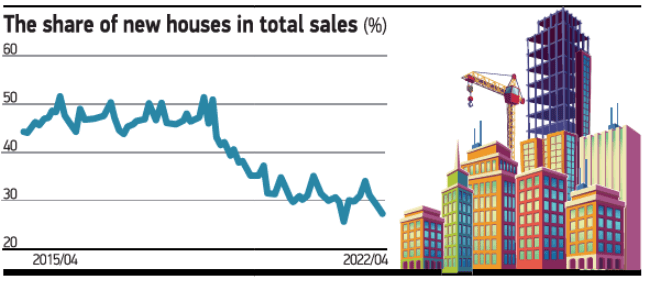

>> The share of new house sales in total sales continues to decline.

>> The gap between new house sales and second-hand sales continues to grow.

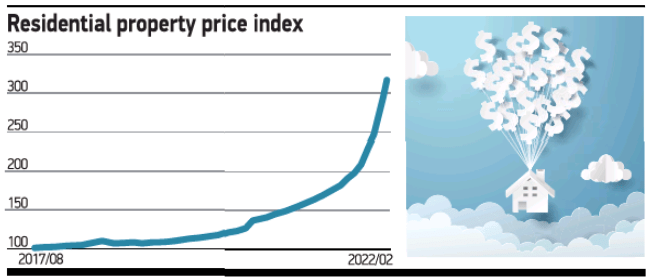

>> Housing prices and rents have nearly tripled in the last two years, and this Monday afternoon we’ll find out what the increase was in April.

POSITIVE SIGNS IN SECTORAL CONFIDENCE

We start this week with the May results of sectoral confidence indices. The consumer confidence index announced last Friday morning was 67.6. While consumer confidence is at historically low levels, it continues to show positive signs on the side of the sector. However, from time to time we express that the gradually widening difference between these two cannot be permanent in the long term. That’s why the data to be announced on Monday is important.

Two of the four sub-indices of consumer confidence announced on Friday fell while two rose. Declining indices are the current economic situation of households and the general economic situation expectation in the next 12 months. The rising ones are the expectation of the economic situation of the household in the next 12 months and the thought of purchasing durable consumer goods in the next 12 months.

Something odd must have caught your attention. The respondents stated that the country’s economy will be in a worse situation next year, but the economic situation in their own households will be better. Normally, these two are expected to move in the same direction, but there may be such small and temporary deviations from time to time in the surveys.

FED MINUTES, PPK DECISION

The Fed minutes, which will be released on Wednesday night, will determine the direction of money and capital markets in the following days. After the collapse in the crypto markets and the decline in the stock market indices, I think the possibility of more moderate statements from the Fed in the coming days is increasing.

Therefore, we may be entering a comfortable period in foreign markets. We do not know to what extent this expectation will be valid in Turkey.

Undoubtedly, the most critical development of the week is the interest rate decision, which will be announced on Thursday. No interest rate change is expected from the Monetary Policy Committee (PPK). Turkey has been witnessing the highest inflation since 2001, the highest CDS premiums and a serious increase in the cost of living, with negative real deposit rates and negative real loan rates for nearly eight months.

NEW COMPANIES VS. UNEMPLOYMENT

On Friday morning, The Union of Chambers and Commodity Exchanges of Turkey (TOBB) will announce the number of new companies established in April. The number of companies established in the first quarter of the year exceeded 32,000, the most companies ever established. There is a direct relationship between new company establishment and non-farm employment. For this reason, we expect new companies to have positive reflections on employment. A positive impact on the employment market can also be experienced in the coming months when refugees residing in Turkey return to their homeland.

This week we will be watching the first-quarter growth data for Germany and the U.S. The German ifo index on Monday morning and the durable goods orders to be announced in the U.S. on Wednesday afternoon could be the determinants.