BY BADER ARSLAN

The winds are blowing in the new direction in the world. The global climate, which was moderately negative a few weeks ago, started to cool suddenly due to the fear of a new recession. The U.S. dollar appreciated against almost everything. In addition to developed country currencies, such as the euro, pound, and yen, developing country currencies, almost the entire coin market, stock exchanges, and commodity prices are all on the decline.

Despite the interest rate hikes on one side, the end of monetary expansion on the other, and the withdrawal of money from the market, the expectations for a faster and more severe monetary contraction than expected increased when inflation reached 8.6% in the United States (U.S.) The probability that the U.S. interest rate will rise to 4% or more in June 2023 has increased from around 1% last month to over 80% today. This deterioration in expectations increases the likelihood of a recession. While Morgan Stanley estimated the recession risk in the next 12 months as 5% in March, it announced that this risk reached 27% in its report dated June 13. A Bloomberg analysis on the same date revealed that this rate was 30%. The decline in U.S. stock indices since the beginning of the year is around 25%, most of which has occurred in the last two months. The direction is the same in European indices, but the decline is somewhat softer.

Last Wednesday was an eventful day. The European Central Bank had an extraordinary meeting. Then, in the evening hours, the Fed increased the policy rate by 0.75 points, higher than previously expected.

However, when a soft tone was taken in the statement made right after, the tension in the markets eased a bit. Still, there is a big difference between the current inflation and policy rates and we will see this gap close with rapid interest rate hikes in the coming period. The U.S. economy is walking a fine line with high inflation on one side and the possibility of a recession on the other.

ALL EYES ON THE PPK DECISION

This week, after the Fed, the Monetary Policy Committee (MPC) will meet to set the policy rate. Although no one expects a change, many people are hoping for this. That’s why people begin stating their questions with “I wonder” before every meeting. However, it is too early to expect a rate change by the MPC. It is not reasonable to have such an expectation, especially after the statements made by President Recep Tayyip Erdogan last week. Therefore, it seems that we will continue with the current policy rate.

The point to note here is that as inflation rises, the need for an interest rate hike increases. Now, as long as the economies that fund the world, especially the U.S., increase their own interest rates, the need for countries like ours to increase their own interest rates will intensify. On top of all this, Credit Default Swap (CDS) is at record levels.

BASE EFFECT ON HOUSING SALES

In May, house sales reached 122,768 with an increase of 107%. Mortgage sales increased by 178% to 29,335. The reason for the high increase in mortgage sales is the low level of sales at the beginning of 2021 due to the tight monetary policy that Naci Agbal started to implement while he was Central Bank Governor. Today, housing purchases are seen as an investment tool in addition to the attractiveness of housing loan rates below inflation.

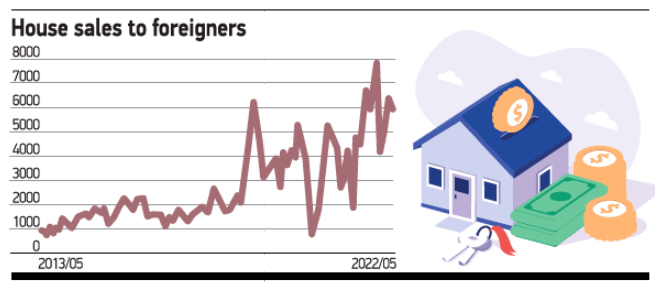

The increase in new house sales was 80% and the increase in second-hand sales was around 120% in May. On the other hand, there was a 236% increase in house sales to foreigners with 5,962 houses sold. The most important reason for the increase in sales to foreigners is the increase in the minimum housing price required to obtain Turkish citizenship from USD 250,000 to USD 400,000. Foreigners with purchasing intentions took action before this change, which was announced in May and took effect in mid-June. The second reason is that the Ukrainians and Russians increased their housing purchases due to the Ukraine-Russia War. As a matter of fact, citizens of these two countries bought one out of every four houses sold in May. Contrary to what is predicted, it is not the Ukrainians who bought the most, but the Russians.

EXPORT INCREASE WILL SLOW

Last Wednesday, Izmir hosted an interesting meeting. Economist Prof. Erhan Aslanoglu made the opening presentation at a meeting organized by daily DUNYA with the Izmir Chamber of Commerce. Aslanoglu’s presentation, which realistically describes global economic developments and their reflections on Turkey, reminded me of a common mistake in Turkey.

Many individuals or institutions think that the increase in the exchange rate is a positive development for our exports. According to this rationale, when the exchange rate rises, the U.S. Dollar and Euro-based prices of the goods we export decrease due to the depreciation of TL, which increases the demand for our goods.

Here is where they are wrong: Our export prices are already extremely low. We have the world’s lowest prices for the goods we sell, from apparel to machinery, automotive to metal products. Competition in Turkey is seen as price competition. Making a product that is already cheap compared to its competitors even cheaper does not increase the demand for it.

Another point where they are wrong is this: a country ’s currency depreciation does not increase that country’s exports. If this were the case, every country would try to devalue its currency. A country ’s exports are determined by internal factors such as production capacity, technological infrastructure and innovative products produced, the growth of export markets, commodity prices and global cyclical developments. The value of money is also important, but its effect is much lower than the factors I mentioned above, and this effect is temporary. The expectations for the growth of the countries we export to are being revised downwards. Completing last year with a growth of close to 6%, the European Union will grow by half of that this year. There is also a slowdown in the U.S. and in neighboring countries. For this reason, the strong export increases that we have seen in the last year will yield to more moderate increases.