BY ALAATTIN AKTAS

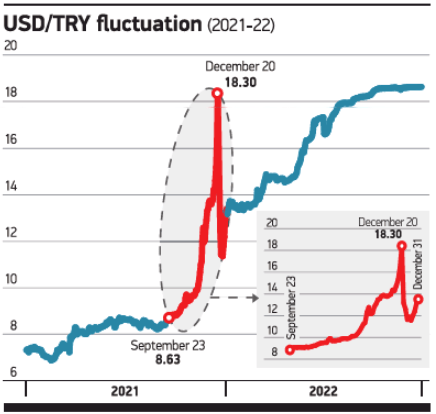

The Central Bank’s (CB) policy rate, which had been kept steady for five months after it was increased to 19% in March, was cut starting on September 23, 2021. The policy rate was cut from 15% to 14% on December 16 and fell below inflation. When people started to buy up foreign exchange (FX), FX rates jumped. President Recep Tayyip Erdogan made clear that there would be continued rate cuts on December 19. People started to invest in FX on December 20. USD/TRY nearly rose by 2.00 in a day. It exceeded 18.00 and hit 18.30. President Erdogan announced the FX-protected TRY deposit accounts (KKM) on the evening of December 20. USD/TRY which had an upward trend for a long time, fell to some 13.00 on December 21. The decline continued and USD/TRY saw 11.00 at one point. The CB and public banks entered the market and started to sell FX. This paved the way for the FX rate to fall. People who bought USD at nearly 18.00 or even higher, went into shock on the morning of December 21 and had to wait for eight-nine months to see the same level. Apparently, KKM had been discussed for a long time. Why weren’t people warned about it to prevent their losses? Was the sharp FX rate done on purpose? Or were there people who made a lot of sales when FX saw the peak on December 20?