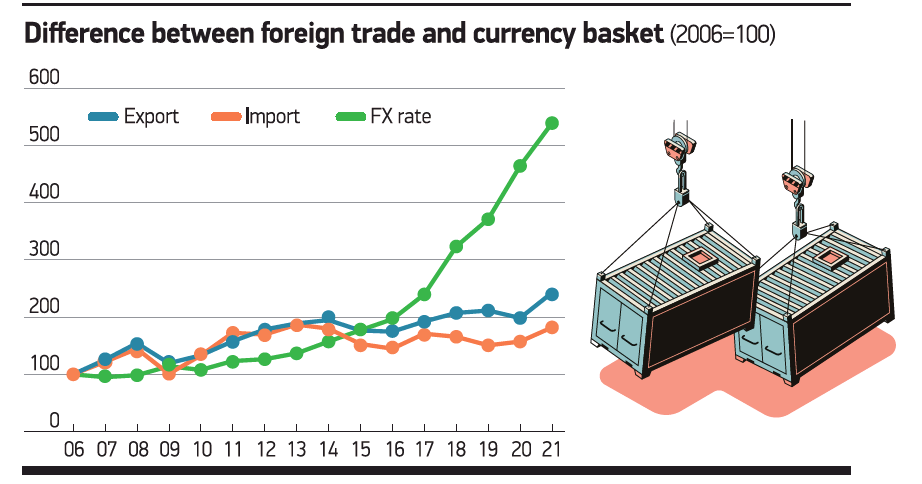

“Exports surge when foreign exchange (FX) rates jump. FX rates should be raised to decrease imports. FX rates should be raised to decrease the foreign trade deficit. Thus, the current account deficit will decline…” I’m mentioning these opinions, but they don’t look at how the FX rate-foreign trade relationship works. Exports and imports had almost a parallel course with the currency basket until 2016. The gap between two indicators, which started in 2017, became clearer in 2018. Then the currency basket climbed and exports and imports followed FX rates. The currency basket index, which stood at 100 in 2006, rose to 196 in 2016. It saw 539 in a year as of August 2021. We didn’t consider the rapid surge in September and October as foreign trade figures for these months haven’t been released yet. But considering the fluctuation in the last two months, the currency basket further increased. That’s the situation. Foreign trade figures are released by the Turkish Statistical Institute and FX rates by the Central Bank. In this case, either this data is wrong, or those who say exports will increase when FX rates surge are wrong, or those who say this want to misguide the society. However, the FX rate hike may contribute to exporters earning more to some extent. I agree with this opinion.