BY ALAATTIN AKTAS

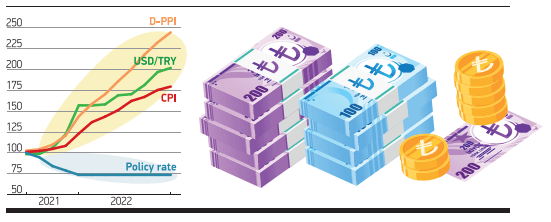

September 23 will be the anniversary of the Central Bank’s (CB) policy rate cut. Consumer prices rose by 2.37% in July, 45.72% in seven months and 79.60% annually. Producer prices surged by 5.17%, 70.04% and 144.61% in the same periods, respectively. The policy rate is at the same level as when inflation was 19% a year ago, back when the USD/TRY was at 8.61! The USD/TRY average was even lower in August and September. The monthly FX rate average prevents FX fluctuation and its adverse impact on the economy from being visible. This became clear in December. USD/TRY jumped rapidly, exceeding 18.00 until December 20. The next day, USD/TRY fell to 11.00-12.00 with FX intervention and the announcement of the FX-protected deposit accounts. Although USD/TRY averaged 13.53 in December, the sharp hike impacted prices, costs rose, and pricing behaviors and forecasts deteriorated. The policy rate cut was estimated to bump up FX rates and prices. The decision was willingly taken to support the market boom. But no one predicted its side effects would be so violent. Consumer inflation jumped from 19% to 80%, producer prices soared from 45% to 145% in a year. TRY devaluated by 50% in this period. Of course, there are still steps that can be taken, but by those who want to take them.