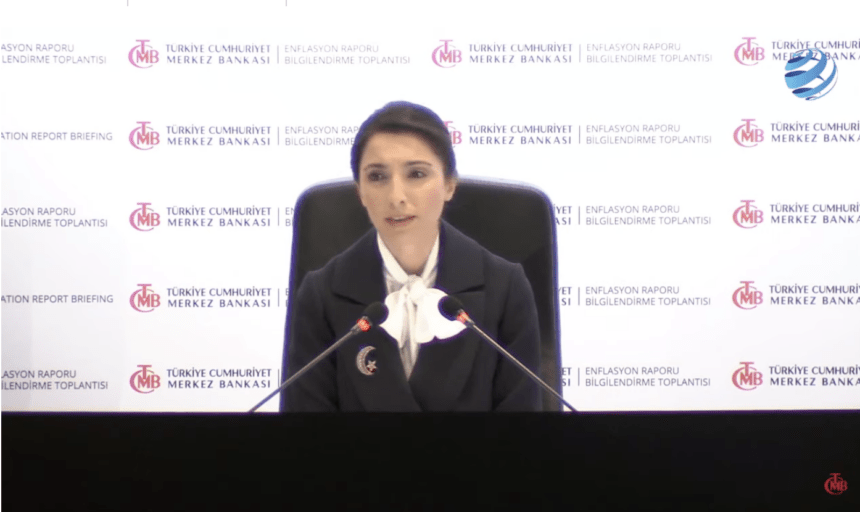

Central Bank (CBRT) Governor Hafize Gaye Erkan announced the 4th Inflation Report of the year. The Central Bank raised its year-end inflation forecast from 58 percent to 65 percent, the target in the Medium Term Plan (MTP). The 2024 inflation forecast was raised from 33 percent to 36 percent, while the 2025 inflation forecast was lowered from 15 percent to 14 percent.

Noting that the deterioration in inflation expectations has slowed month-on-month, CBRT Governor Erkan said, “September inflation, October’s high-frequency data and all leading indicators suggest that the reflection of these shocks on inflation is largely complete.” Erkan, however, stated that price rigidity in services will continue to affect inflation.

Erkan said that they expect the disinflation process to start in the second half of 2024.

CBRT Governor announced that total sterilization will exceed TRY 1 trillion with the withdrawal of an additional TRY 350 billion liquidity from the system with the latest reserve requirement decisions.

– In the second half of 2024, we expect a strong and sustained disinflation process to begin as the cumulative effects of monetary tightening kick in.

– As we have stated in our previous policy papers, we are still in the transition period before the disinflation and stabilization process we envisage

Highlights of CBRT Governor Erkan’s presentation:

Inflation expectations

– As the CBRT, our task is to achieve disinflation as soon as possible and bring inflation back to single digits in line with our price stability objective.

– We will continue to use all our tools decisively until there is a significant improvement in the inflation outlook.

– We are already receiving some leading signals from domestic demand regarding rebalancing.

– We expect the disinflation process to start in the second half of 2024.

– The widespread effects of monetary tightening are spreading over time.

– Portfolio outflows from emerging economies have been observed recently.

– I would like to emphasize as a positive development that financing conditions in Turkey remain balanced despite all the negative shocks.

– The rise in inflation between June and September was caused by major shocks.

– September inflation, the high-frequency data in October and all leading indicators suggest that the reflection of these shocks on inflation is largely complete.

– Demand remains strong but is losing momentum. Normalization of the supply-demand balance has started gradually.

– Price rigidity in services will continue to affect inflation. We are seeing signs of a slowdown in price increases in rental ads, especially in big cities, but it will take time to be reflected in inflation.

– The deterioration in inflation expectations has slowed month-on-month.

-The rebalancing of consumption demand is supported by the increased demand for lira savings instruments during the monetary tightening process.

– Leading indicators for October suggest that monthly inflation will continue to decline.

Inflation forecasts

We forecast inflation to be realized as 65.0% by the end of 2023 (Previous 58.0%)

We forecast inflation to be realized as 36.0% at the end of 2024 (Previous 33.0%)

We forecast inflation to be 14.0% by the end of 2025 (Previous 15.0%)

Monetary tightening policies

– The monetary tightening process is being strengthened with a holistic approach.

– Quantitative tightening continues through sterilization of excess liquidity.

– With today’s decisions, the total sterilization will exceed TL 1 trillion with the withdrawal of an additional TL 350 billion of liquidity from the system.

– The macroprudential framework has been significantly simplified in the last 5 months.

– Market rates are evolving in line with our policy decisions.

– Consumer loan growth has started to normalize.

– Commercial loan composition is supported by export and investment loans.

– Rediscount and advance loans with investment commitments made a significant contribution to the commercial loan composition in the last 3 months.

– While FX and FX deposits decreased, TL deposits increased.

– The share of TL deposits in total deposits increased by around 5 percent.

– As of October 20, reserves rose above USD 126 billion.

– Risk premium and manufactured exchange rate volatility improved significantly.