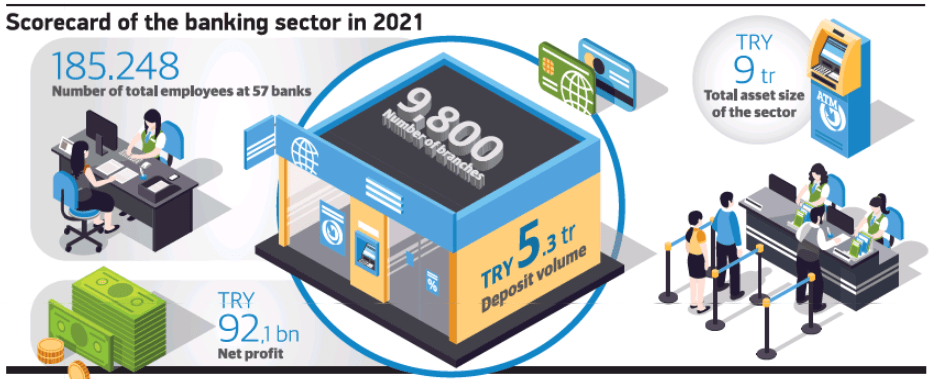

The total assets of the Turkish banking sector consisting of 57 public and private banks, which have overcome the structural changes during the pandemic and the sharp foreign exchange (FX) rate increase, exceeded the threshold of TRY 9tr last year, according to a report prepared by the audit, tax and consultation services company KMPG Turkey. The sector’s deposit volume hit a historic high of TRY 5.3tr last year after the value of foreign exchange deposit accounts increased following the TRY devaluation. The total net profit of the sector, increased by over 57% to TRY 92.1bn in 2021, compared to the end of 2020, while its loan volume exceeded TRY 5tr last year. In line with the change in digitalization and customer choices, the number of employees in the sector fell to 185,248 and the total number of branches, which fell below 10,000 in 2020, declined by 147 to 9,800 in 2021 as compared to 2020. The Turkish banking sector’s total equity capital reached TRY 711bn. The top three banks in terms of the sector’s asset size were public sectors in 2021. The annual credit growth of the banking sector saw 37% last year. Non-performing loans of the sector totaled TRY 160bn in 2021. The sector’s profitability is estimated to increase by 150% this year.