BY TALIP AKTAS

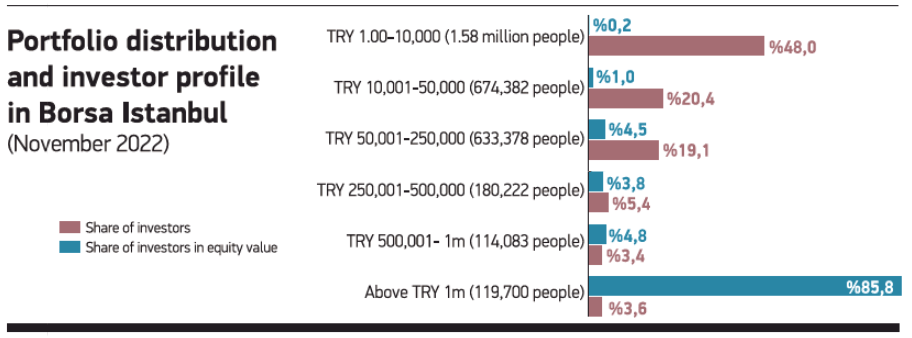

Borsa Istanbul’s BIST 100 Index jumped 180% from 1,800 points to 5,000 points in 12 months. The return is good for a period when the deposit interest rate (IR) rose by 27%, bond IR increased by 10-11%, pressured USD/TRY surged by 50%, and gold climbed by 35% compared to TurkStat’s inflation of 85.5%. The inflation-adjusted (real) annual return of equities hovers around 32%. The increase in competition among the listed firms is a miracle of monetary policy, which provides deposit IRs that exceed loan IRs. Investors that escape from traditional deposits and FX-protected TRY deposit accounts (KKM) with the pressure on FX rates run to Borsa Istanbul. The number of domestic equity investors has exceeded 3.3 million as of November 30, according to the Central Securities Depository of Turkey (MKK). The number of investors who have newly entered Borsa Istanbul is nearing 1 million in 11 months. The market value of equities jumped 92% from TRY 872.4bn to TRY 1.67tr. The share of equities held by 1.6 million people, or nearly 50% of the investors on Borsa Istanbul, was 0.18% in October. Their portfolio size was between TRY 1 and TRY 1,000. 3.6% of investors, or around 120,000 people, hold 86% of equity assets. The portfolio size of each of these exceeds TRY 1m.